Together with

Good Morning,

Musk's net worth hit $600B, PayPal applied to become a bank, Nasdaq filed plans for around-the-clock trading, Tesla board made $3B in stock awards, AQR is having a comeback moment, and US launched a 'Tech Force' to recruit AI talent for government initiatives.

It's almost year-end – if you haven't heard from your CPA since April, their silence is likely costing you money. Check out OLarry, a proactive, year-round tax advisory service for individuals and businesses with complex taxes. All for a flat price, no surprises.

Let's dive in.

Before The Bell

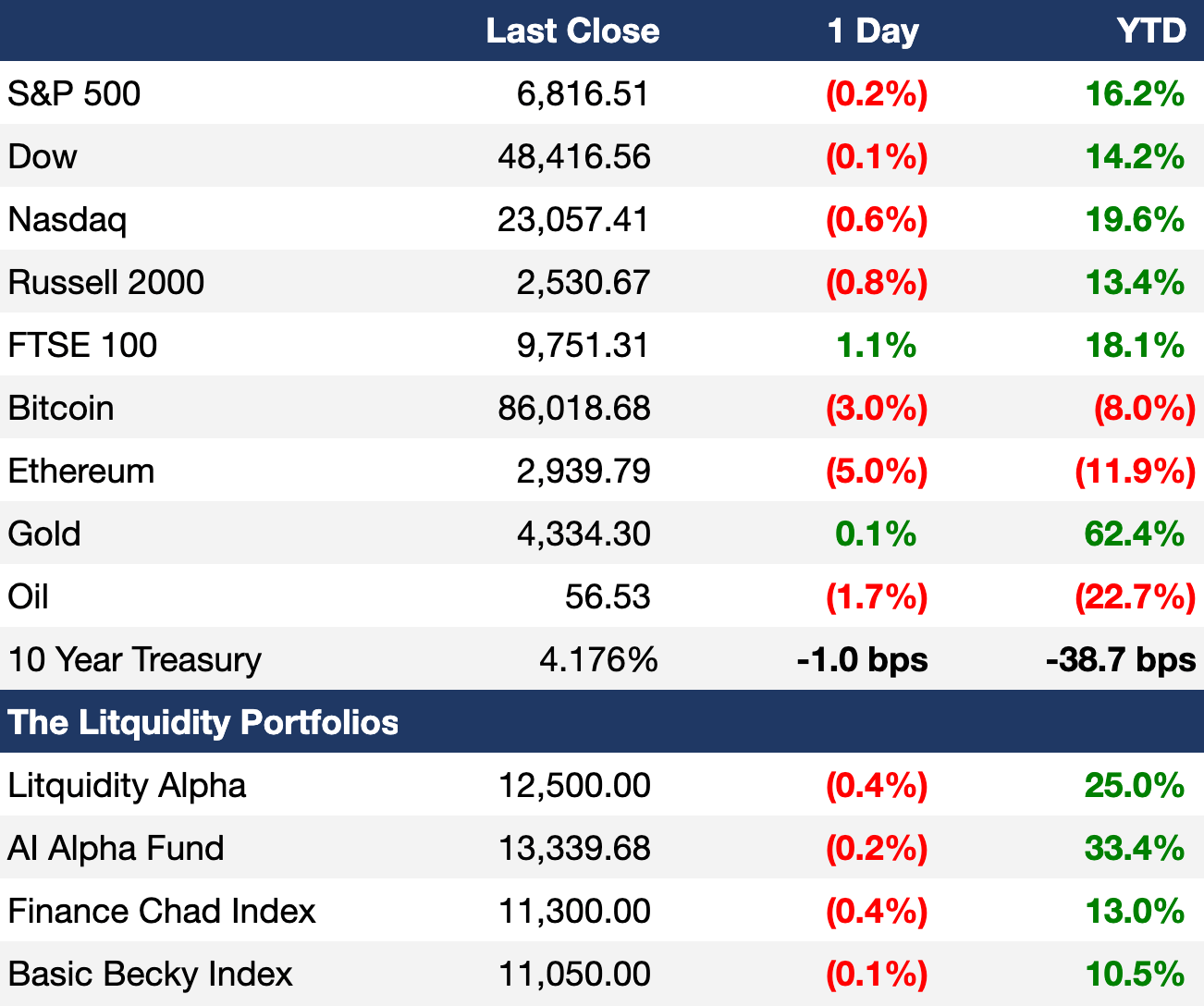

As of 12/15/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks slipped further yesterday as investors braced for a slate of long-awaited (but incomplete) economic data

UK's FTSE 100 is set for its best year in sixteen years despite a dead IPO market

Oil fell to its lowest since February 2021

Swedish krona is up 5% versus euro and up 20% versus dollar in its best run in over two decades

Earnings

What we're watching this week:

Wednesday: Micron, General Mills

Thursday: Accenture, Nike, FedEx, CarMax, Darden Restaurants

Friday: Carnival

Full calendar here

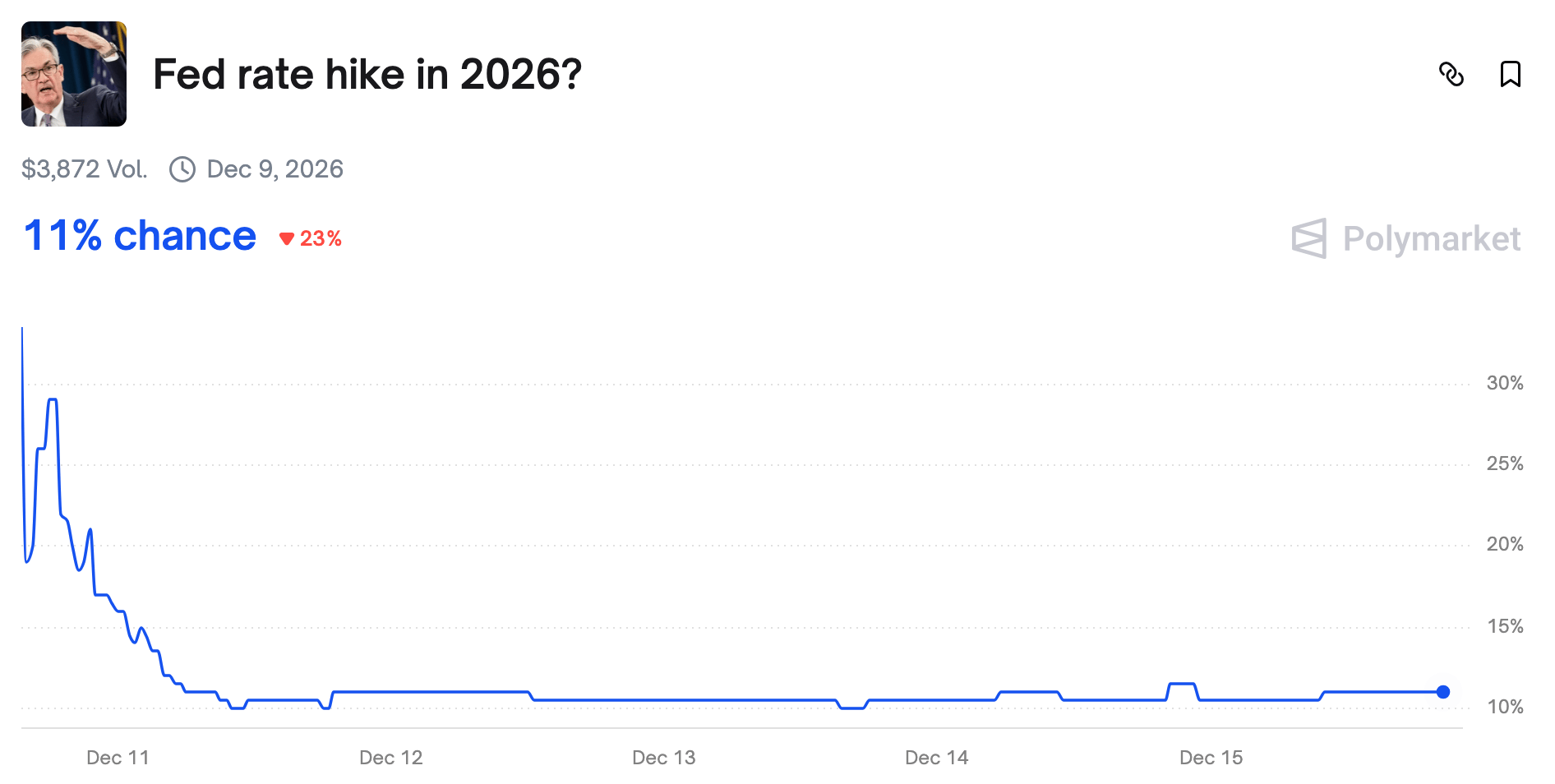

Prediction Markets

Meanwhile, Trump is hoping for a sub-1% terminal rate

Trade your forecast on the Fed's rate cutting cycle on Polymarket

Headline Roundup

Trump said Ukraine peace deal is 'closer than ever' (FT)

Trump's top allies push back against Kevin Hassett for Fed chair (CNBC)

Fed's Stephen Miran says 'phantom inflation' is distorting Fed decisions (FT)

Hedge funds are dumping Asian tech stocks (RT)

Warner Bros. deal is blockbuster finale to $4.5T M&A haul (BBG)

Hong Kong's blockbuster IPO year is set for blockbuster December (BBG)

CLO managers bet big on M&A revival to lift 2026 profits (BBG)

EM dollar bond ETF inflows surged to a three-year high (BBG)

Israeli tech sector deals hit $60B this year (RT)

US bank lending to competitors surged 26% (BBG)

Nasdaq will file plans for around-the-clock trading (RT)

Goldman Sachs restructured TMT IB group to focus on AI (RT)

JPMorgan's global chair of IB Jamie Grant will retire (RT)

AQR roars back with $180B AUM and taste for secrecy (BBG)

PayPal applied to become a bank (BBG)

Tesla board made $3B in stock awards (RT)

B. Riley Financial filed overdue 10-Q in step to staying listed (BBG)

OpenAI poached Google's Albert Lee for VP of corp dev (RT)

McKinsey will cut 10% of non-client-facing jobs (BBG)

Frontier Airlines fired CEO Barry Biffle (CNBC)

Ben & Jerry's ousted board chair Anuradha Mittal (RT)

Musk's net worth hit $600B (RT)

Ford will take a $20B hit on EVs (WSJ)

US launched 'Tech Force' to recruit AI talent for government work (CNBC)

JPMorgan will allow Europe HNW clients to borrow against luxury cars (BBG)

A Message from OLarry

OLarry: Proactive tax advisory for individuals and businesses with complex needs

Go beyond traditional tax filing with:

White Glove Service: Access a level of service previously only accessible by the ultra-high net worth

Unlimited Strategy: Year-round access to US-based experts

Proven Track Record: Trusted by thousands of individuals and businesses

Comprehensive Coverage: Specializing in K-1s, Stock Comp (ISOs, RSUs, ESPP), Multi-State Compliance and more

"Easily the best and most strategic tax convos I've had." -Raj, CEO

Book a free consultation today and get 10% off with code Execsum.

Deal Flow

M&A / Investments

PE firms TowerBrook, Warburg Pincus, and Stonepeak are exploring a sale or IPO of UK roadside recovery firm AA at a ~$6.7B valuation

Canadian engineering firm WSP agreed to buy US peer TRC from Warburg Pincus in a $3.3B all-cash deal

Japan's MUFG is nearing a deal to buy a 20% stake in Indian shadow lender Shriram Finance for $3.2B

French pharma company Sanofi agreed to pay US biotech Dren Bio up to $1.8B to develop autoimmune drugs

Mexico Infrastructure Partners agreed to acquire wind and solar assets in US and Mexico from Acciona Energy for $1B

UK PE firm BC Partners is nearing a deal for a majority stake in shipping, fulfillment and marketing services firm Fortidia from founders and Oaktree for $940M

UK PE firm DBAY withdrew its rejected bid for UK electronics manufacturer TT Electronics, leaving Swiss electronics firm Cicor's $385M all-cash offer as the sole proposal

China's Fosun Pharma agreed to acquire a 53% stake in Alzheimer's therapy firm Green Valley Pharmaceutical for $200M

Italian family office Exor rejected Tether's $634M all-cash bid for a 65.4% stake in Italian soccer club Juventus

Australian mining giant Fortescue agreed to acquire the remaining 64% stake in copper miner Alta Copper at a $101M valuation

Mexican billionaire Fernando Chico Pardo acquired a 25% stake in Citigroup's Mexican retail bank Banamex

Nvidia will acquire AI software provider SchedMD

IG4 Capital agreed to acquire a stake in Brazilian petrochemical producer Braskem from Novonor

US plans more 'historic deals' with mining sector in pivots to critical sectors

Select VC Deals

PolyAI, an enterprise conversational AI platform, raised an $86M Series D co-led by Georgian, Hedosophia, and Khosla Ventures

AI-enabled drug discovery startup ChemLex raised a $45M round led by Granite Asia

AI audio startup Mirelo raised a $41M seed round led by Index Ventures and a16z

AI patent-workflow startup Solve Intelligence raised a $40M Series B co-led by Visionaries and 20VC

Axion, a pioneering AI platform for manufacturing product quality, raised a $37M Series B led by Salesforce Ventures

BlackRock and JPMorgan-backed Texas Stock Exchange raised $20M from Goldman Sachs and Bank of America

Trustyfy, a DeFi banking startup, raised a $6.8M round led by Tokenee Select and the Sixth Society Angel Syndicate

Get real-time updates on any startup, VC, or sector. Try Fundable.

IPO / Direct Listings / Issuances / Block Trades

Blackstone, Carlyle, and Hellman & Friedman-backed medical supplies firm Medline priced its IPO near the top of a marketed range to raise ~$5.4B in what is this year's biggest listing

Singapore SWF GIC and PE firms CVC and Silver Lake are exploring an IPO or sale of UK roadside assistance firm RAC at a ~$6.7B valuation

Hong Kong crypto exchange HashKey raised $206M in a Hong Kong IPO

Indian audio content platform Mebigo Labs is seeking to raise $200M in an India IPO

HVAC firm Madison Air Solutions confidentially filed for an IPO

Malaysia's largest online insurance aggregator Bjak is weighing an IPO

World's biggest in-flight caterer Gategroup selected banks for a Swiss IPO

Debt

Fannie Mae and Freddie Mac grew their retained portfolios by over 25% through October, reaching a combined $234B

Japanese lender SMBC's APAC arm completed its first $3.2B SRT deal with Blackstone, Stonepeak, and Clifford Capital

Greek lender Eurobank is planning two SRT deals tied to $2.3B of corporate loans

Animal medicine company Zoetis is seeking to raise $1.75B in a convertible bond sale

US firefighting chemical producer Perimeter Solutions raised $550M in a secured notes sale

Bankruptcy / Restructuring / Distressed

Spirit Airlines secured a $100M DIP lifeline to stay afloat in Chapter 11

Telecom infrastructure firm CommScope lenders are demanding immediate loan repayment plus a $100M make-whole premium, arguing a recent asset sale triggered a default

LiDAR sensor manufacturer Luminar Technologies filed for Chapter 11 following the loss of a contract with Volvo

Fundraising / Secondaries

Lightspeed Venture Partners raised $9B across six funds targeting AI in its largest fundraising haul ever

BlackRock lost another $6B equity mandate from Dutch pension PME over ESG pullback concerns

Dragoneer raised $4.3B for its seventh VC fund

Private credit firm Pathlight Capital raised $1.9B across its fourth ABL credit fund and second tranche of its evergreen fund

PE firm Stone Point Capital is testing a $1B evergreen fund that will one day open to individuals investors

BNP Paribas' AXA Investment Managers raised a $535M seed commitment for its carbon transition global core credit fund from WTW's master trust

Abu Dhabi SWF Mubadala and investment firm Barings launched a $500M JV targeting CRE debt investments across US, Europe, and APAC

Israeli VC Viola Ventures raised $250M across its seventh flagship early-stage fund and first secondaries fund

Spanish VC Kibo Ventures raised $95M for a targeted $175M fourth fund

Japanese imaging technology firm Olympus Corporation committed $150M for a second VC fund focused on medtech

Crypto Sum Snapshot

JPMorgan will launch its first tokenized money market fund

Strategy acquired $1B in Bitcoin for a second-straight week

Crypto investor Olivier Janssens plans Caribbean community with own court system

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Bloomberg Odd Lots sat down with Klarna CEO Max Levchin to hear how BNPL really works.

Sam Ro wrote a great piece on the (non-existent) correlation between valuations and forward stock market trends.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.