Together with

Good Morning,

Adam Neumann wants to rebuy WeWork, Snap’s stock tanked after earnings (again), tech layoffs keep coming, the SEC is increasing oversight of hedge funds, NYCB’s credit grade got cut to junk by Moody’s, and Tucker Carlson is interviewing Putin.

But most importantly, Litquidity’s identity has finally been revealed in an exclusive interview with the Financial Times. You can check out the article here. More information behind the reason for revealing his identity will be released later this week!

Need last minute help with marketing services? Today’s sponsor, Superside, is the one-stop shop creative-as-a-subscription service that will get you content from the world’s top designers in less than 24 hours.

Let’s dive in.

Before The Bell

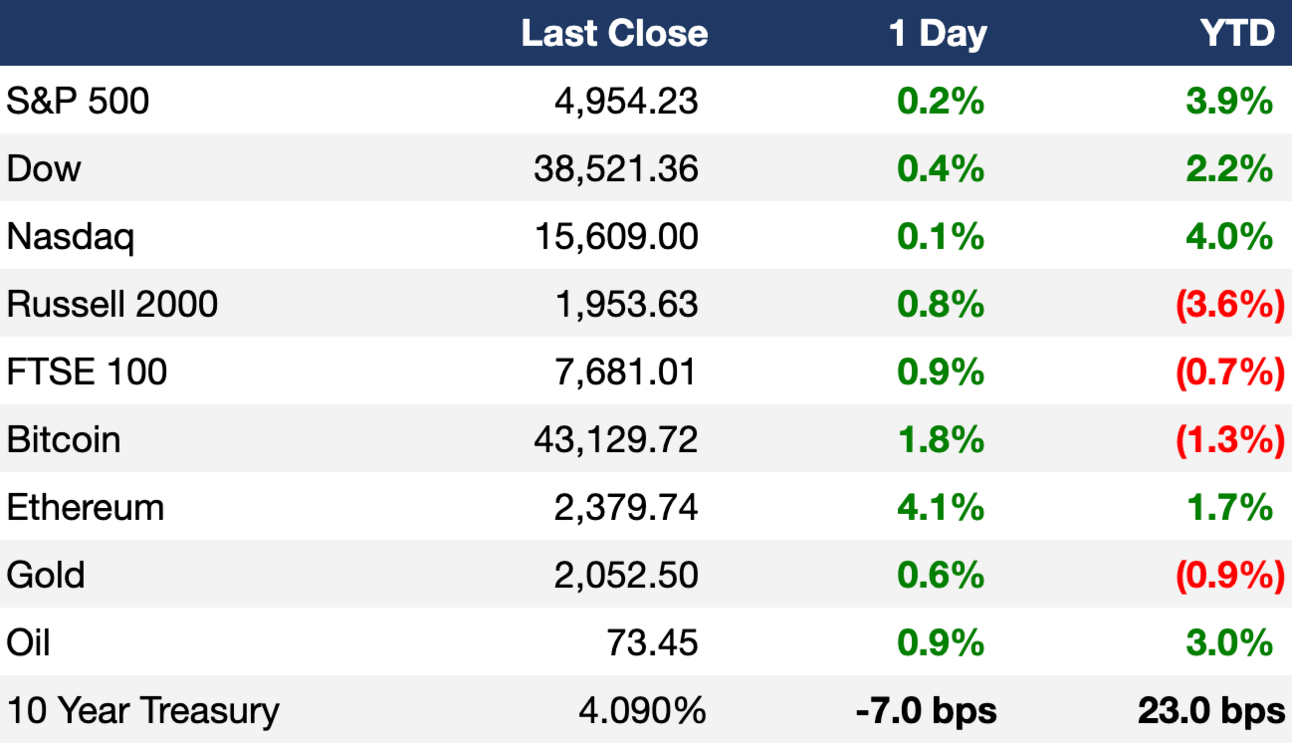

As of 2/6/2024 market close.

Markets

US stocks rose as investors digested corporate earnings and the Fed’s timeline for possible rate cuts

The Dow led indices with a 0.37% gain

Asian stocks closed mix, although Chinese stocks jumped, notching their best day in years thanks to promised support from China’s sovereign wealth fund

European stocks rose thanks to corporate earnings and a decline in Euro zone inflation expectations

Earnings

KKR shares rose ~6% after reporting higher quarterly earnings driven by appreciation in its investments (WSJ)

Snap shares plunged ~31% after missing Q4 analyst revenue expectations and issuing a disappointing Q1 forecast (CNBC)

BP shares rose ~6% after reporting higher-than-expected Q4 profit, accelerating the pace of its buybacks, and increasing its dividend (CNBC)

What we're watching this week:

Today: PayPal, Walt Disney, Uber, Alibaba, CVS

Thursday: Apollo Global, ConocoPhillips, Affirm, Pinterest, Cloudflare

Friday: PepsiCo

Full calendar here

Headline Roundup

Tech layoffs just keep coming as sector resets for AI (WSJ)

SEC increases oversight for hedge funds, high-speed traders (WSJ)

Europe’s green agenda collides with geopolitical, economic reality (WSJ)

NYCB’s credit grade is cut to junk by Moody’s (BBG)

Yellen says commercial property is a worry, but regulators are on it (BBG)

ESPN, Fox, and Warner Discovery are teaming up to create a new sports streaming venture (WSJ)

Tucker Carlson set to interview Vladimir Putin (CNBC)

Meta is trouncing Snap in digital ads (CNBC)

Sports betting and Swifties converge on the Super Bowl (AX)

German manufacturing orders unexpectedly soar on aircraft purchases (WSJ)

Amazon is laying off hundreds in its health care operation (BBG)

Xi to discuss China stocks with regulators as rescue bets build (BBG)

Toyota cashes in on booming hybrid sales (WSJ)

Biden blames Trump for sinking bipartisan immigration bill (RT)

A Message From Superside

Your Answer To Time-Consuming High-Quality Content

It's 3 am, and you find out you need creative for an ad campaign.

Sound familiar?

If you are getting panic sweats, we're sorry. 🤣

As marketers, we know the exhausting game of producing high-quality content in a short time frame.

Imagine getting a piece of content from some of the top 1% of designers IN THE WORLD in less than 24 hours. 🌎

No joke, it's possible with Superside. The #1 creative-as-a-subscription service, trusted by over 450 brands, including Google, Meta, Reddit and Shopify. 🥇

Wasting energy on small tasks? - Superside

Inundated by too many requests? - Superside

Not feeling creative? - Yep, Superside

No more vetting freelancers, and no more panic sweats.

Superside's CaaS (Creative as a Service) removes the weight of creating high-quality content. It's like instantly hiring 20 people.

👉🏼 And as an Exec Sum reader, you get a free consultation here

Deal Flow

M&A / Investments

Australia’s largest oil and gas producer Woodside Energy Group ended talks with smaller rival Santos over a potential $57B combination due to valuation issues (BBG)

PE firm Permira is assessing options including a sale of German fashion retail club Best Secret, which could be valued at more than $4.3B in a sale (BBG)

Japan’s second-biggest mobile carrier KDDI launched a $3.3B tender offer for joint control of the Lawson convenience store chain; Mitsubishi currently owns half of Lawson (FT)

German state-owned development bank KfW plans to raise as much as $2.3B by selling a ~4% stake in the country’s former state mail monopoly Deutsche Post (BBG)

A trio of Brazilian firms including lenders Bradesco and Banco do Brasil launched a tender offer to take payments company Cielo private in a deal worth up to $1.2B (RT)

Blackstone is exploring a sale of its 49.9% stake in French telecom infrastructure provider Sipartech, which could value the company at $1.1B (RT)

Telecom Italia is set to reject Italy’s bid of up to $805M for its submarine cable unit Sparkle (BBG)

US software company Entrust is in advanced talks to acquire British technology group Onfido, which could be valued at ~$650M in a deal (RT)

Clean Harbors agreed to acquire HEPACO, an environmental and emergency services provider, from Gryphon Investors for $400M (BW)

PE firm Haveli Investments will take cybersecurity provider ZeroFox Holdings private in a $350M deal (GNW)

Sovereign wealth fund Abu Dhabi Investment Authority is considering purchasing a minority stake in Dalian Wanda Group’s mall operator (BBG)

Adam Neumann and other investors including Dan Loeb’s Third Point are exploring an offer to buy WeWork out of bankruptcy (BBG)

VC

NinjaOne, an IT platform for endpoint management, security, and visibility, raised a $231.5M Series C led by ICONIQ Growth (BW)

Sidewalk delivery robot startup Starship Technologies raised a $90M round co-led by Plural and Iconical (TC)

Ambience Healthcare, a startup building an ‘operating system’ for healthcare organizations, raised a $70M Series B led by OpenAI and Kleiner Perkins (TC)

Indian electric two-wheeler startup River raised a $40M Series B led by Yamaha Motor (TC)

Avnos, a startup developing hybrid direct air capture technology, raised a $36M Series A led by NextEra Energy Resources (BW)

SaaS-based workflow automation platform Screendragon raised a $27M round from Kennet Partners and Federated Hermes Private Equity (FN)

Estonian core banking startup Tuum raised a $26.9M Series B led by CommerzVentures (EU)

Mobile payment app Oobit raised a $25M Series A led by Tether (FN)

Colossyan, a London-based startup building AI video for workplace learning, raised a $22M round led by Lakestar (FN)

10Beauty, a startup building an automated salon-quality manicure machine, raised a $17M Series A extension led by Shine Capital (VC)

Attack surface management platform Ionix raised a $15M Series A extension from Maor Investments (TC)

Synthetaic, a startup using synthetic data to train AI models, raised a $15M Series B led by Lupa Systems and TitletownTech (TC)

Adroit Trading Technologies, a buy-side provider for fixed income cash and derivatives, raised a $15M Series A led by Centana Growth Partners (BW)

Fintech startup helping businesses automate accounting and finance functions Finally raised $10M in funding led by PeakSpan Capital (TC)

Jam, a startup improving internal bug reporting, raised an $8.9M Series A led by GGV Capital (TC)

Peripass, a SaaS startup organizing truck movements for logistics sites, raised $8.3M in funding led by Belgian fund “Welvaartsfonds” and Groep Van Overstraeten (FN)

Open source ‘headless commerce’ builder Saleor raised an $8M seed-extension round led by Target Global (TC)

Blush, an invite-only dating app, raised a $7M seed round with participation from Naval Ravikant, Larry Rudolph, and more (TC)

Volta Insite, an electrical data collection and power quality monitoring startup, raised a $7M seed round (VC)

AI-powered search engine Dexa raised a $6M seed round led by Abstract Ventures and The General Partnership (FN)

IPO / Direct Listings / Issuances / Block Trades

American Healthcare REIT priced its shares at the bottom of a marketed ranged to raise $672M (BBG)

Kyverna Therapeutics plans to raise up to $305M and expects a valuation of up to $857M in its US IPO (RT)

German tank gear manufacturer Renk increased its IPO by ~$54M to sell around $537M worth of shares in its private placement (RT)

Debt

Fundraising

Crypto Corner

Digital Currency Group objected to subsidiary Genesis’ bankruptcy plan, arguing that the crypto lender should pay customers no more than the value the crypto had in January 2023, when Genesis filed for bankruptcy (RT)

Self-proclaimed Bitcoin inventor Craig Wright denied forging documents to support his claim that he created Bitcoin (RT)

Exec’s Picks

Litquidity, the finance meme page that was launched in 2017, has always been run by an anonymous individual. Today, his identity has been revealed in an exclusive interview with the Financial Times. Read about his journey, what he’s up to, and what’s in store for the brand

Nick Maggiulli shared a good list of a few overrated parts of personal finance

Ben Thompson gave a detailed review of Apple’s Vision Pro headset

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter