Together with

Good Morning,

AMC’s CEO Adam Aron got blackmailed, the US denied Iran access to the $6B it was receiving as part of a prisoner swap, Scalise dropped out of the US House race, Americans failed to pay a record $668B in taxes, theaters are showing Taylor Swift’s concert, and Europe gave TikTok’s CEO 24 hours to respond about Israel - Hamas misinformation.

Ever wonder if your financial advisor is worth the money? Today’s sponsor, Rainbook, can evaluate them and help you find a replacement, free of charge.

Let’s dive in.

Before The Bell

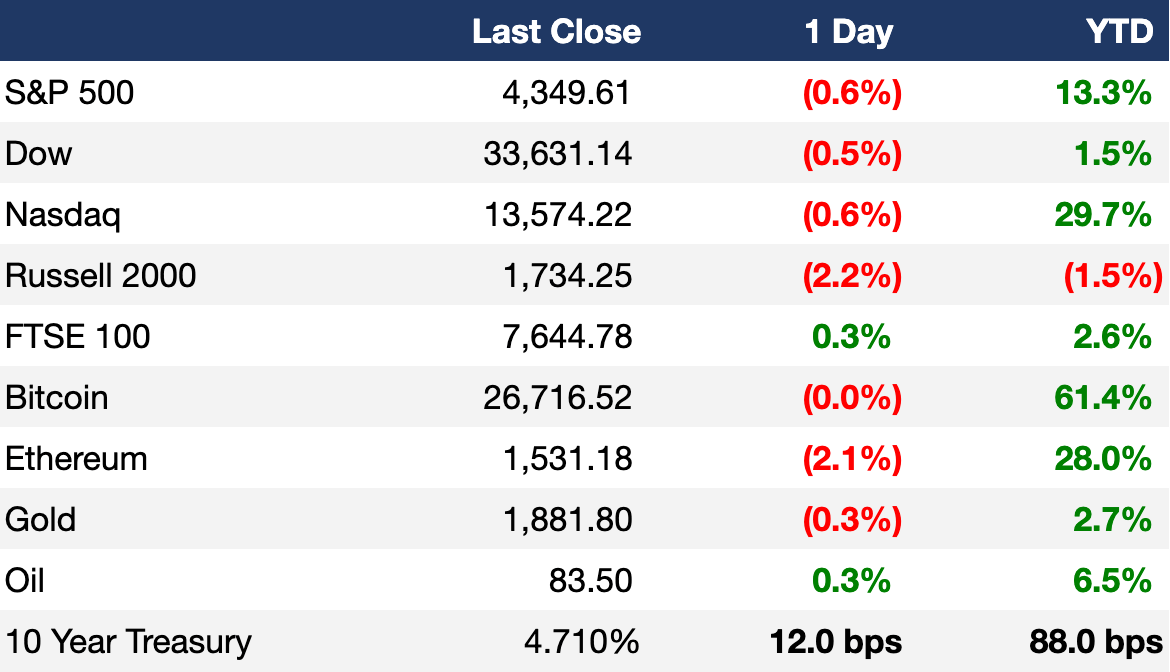

As of 10/12/2023 market close.

Markets

US stocks declined as investors reacted to September’s CPI report that showed more persistent inflation

The Nasdaq led indices with a 0.63% decline

Asian stocks rose, continuing their winning streak, on hopes of Chinese government stimulus and news that Beijing increased its ownership stake in the country’s largest banks

Earnings

Delta Airlines reported a 60% increase in profit that beat analyst expectations thanks to a strong summer, especially for international flights, but Delta lowered its full-year profit forecast due to a jump in fuel prices (CNBC)

Walgreens stock rose 7% despite missing adjusted Q4 profit expectations and forecasting soft profit guidance; the company also reported narrower losses and is progressing in its cost-cutting plans (CNBC)

Domino’s Pizza beat Q3 analyst revenue and profit estimates, though international earnings growth came in below expectations largely due to the disaggregation of the pizza company’s Russian stores (MS)

What we're watching this week:

Today: JPMorgan Chase, BlackRock, Wells Fargo, Citigroup, UnitedHealth Group

Full calendar here

Headline Roundup

US to hold off on disbursing $6B in Iran oil revenue unfrozen in prisoner deal (WSJ)

Dreams of big treasury gains backfire with $10B ETF loss (BBG)

Scalise drops out of US House speaker race, adding more chaos (BBG)

Americans failed to pay a record $688b in taxes. The IRS says that will change (WSJ)

Ford says it’s ‘at the limit’ of what it can offer UAW as strikes escalate (CNBC)

Theaters prep for Taylor Swift concert movie mayhem (WSJ)

Qualcomm to cut roughly 1,258 jobs in California (CNBC)

Africa’s exports could soar close to $1T under trade deal (BBG)

AMC CEO Adam Aron says he was victim of blackmail plot (WSJ)

Chile finance minister downplays inflation currency slump (BBG)

Apollo CEO Marc Rowan demands UPenn leaders to quit over antisemitism (BBG)

Europe gives TikTok CEO 24 hours to respond about Israel-Hamas war misinformation (CNBC)

Bank of Korea warns of potential oil impact from conflict (BBG)

Clothing prices drop most since 2020 ahead of holiday season (BBG)

A Message From Rainbook

How Good Is Your Financial Advisor?

Between multiple asset classes, as well as thousands of stocks and ETFs, investors have never had more options for their portfolios, making financial advisors more important than ever.

This raises two important questions for investors:

How do you really know if your financial advisor is any good?

Where do you find an upgrade if they aren’t?

Rainbook’s Advisor Analyzer is a free platform that:

Evaluates your financial advisor on six factors (Portfolio Performance, Fees, Engagement, Credentials, Statements, Alternatives)

Compares your returns to their benchmarks

Breaks down how much you are actually paying in fees to help you make more informed decisions with your investments

If you aren’t satisfied with your advisor’s performance, Rainbook can also pair you with a new advisor more aligned with your investing goals, to ensure your financial health is taken care of.

If you want to review your advisor’s performance, or you’re looking to get started with an advisor for the first time, you can check out Rainbook here:

Deal Flow

M&A / Investments

Comcast and Disney hired investment banks to appraise Hulu as part of a five-year process to put the streaming platform under one owner; Hulu has a minimum valuation of $27.5B (CNBC)

EU regulators ordered genetic testing company Illumina to sell cancer test maker Grail, which it acquired for $7.1B, for completing the deal before securing EU approval (RT)

British billionaire Jim Ratcliffe is emerging as the frontrunner to buy into Premier League team Manchester United, which has a $3.2B market cap, thanks to his recently revised offer (BBG)

AccorInvest Group, one of the world’s largest hotel owners, is looking to sell $2.1B worth of hotel assets in Latin America and Europe to reduce debt (BBG)

Australian collaboration software company Atlassian will buy privately held video messaging platform Loom for ~$975M (RT)

Industrial and automotive supplier Stabilus will acquire Dover’s DESTACO business, which is an industrial automation component supplier, at a $680M EV (RT)

Apollo Global Management will buy The Restaurant Group, the owner of Wagamama, for $623M (BBG)

Hong Kong PE firm Templewater is nearing a deal to buy a controlling stake in Luye Medical Group’s oncology and cardiology businesses in Singapore at a ~$337M valuation, including debt (BBG)

Brooks Macdonald, a UK wealth manager worth ~$325M that oversees $20.7B in client assets, is working with a defense advisor on strategy amid takeover interest (RT)

German insurance heavyweight Allianz will acquire financial services company Generali’s TUA Assicurazioni for $295M cash (RT)

Filipino power retailer Manila Electric’s MGen Renewable Energy unit will invest $280M to buy shares in solar energy company SP New Energy (BBG)

US investment firm Live Ventures offered to acquire hardwood flooring retailer LL Flooring Holdings for ~$180M cash (RT)

PGA Tour began a formal process to review outside investments separate from its negotiations over a deal with Saudi Arabia’s PIF (FT)

Lender Antares Capital is weighing an acquisition of European private credit rival Hayfin Capital Management to create a private credit behemoth (BBG)

PE firm Platinum Equity emerged as the lead bidder for Jacobs Solutions’ federal consulting unit Critical Mission Solutions (BBG)

VC

Charging infrastructure startup EVPassport raised a $200M round from Northleaf Capital Partners (TC)

Augmented reality startup Mojo Vision raised a $43.5M Series A co-led by Khosla Ventures and NEA (TC)

Employee experience platform Harri raised a $43M growth equity round led by Atalaya Capital Management (VC)

Embedded insurtech platform provider Matic raised a $20M Series B extension led by IA Capital Group and Cultivation Capital (FN)

Collaborative sustainability platform Scope3 raised a $20M Series B led by GV (BW)

AOA Dx, a startup developing an ovarian cancer detection test, raised a $17M round led by Good Growth Capital (FN)

Wearable monitoring startup RDS raised a $13.7M seed round from Capital Grand Est (EU)

Lakera, a startup aiming to protect large language models from malicious prompts, raised a $10M round led by Redalpine (TC)

Intento, a machine translation and multilingual generative AI platform, raised an $8M Series A led by Somersault Ventures (PRN)

Lanch, a startup creating food delivery brands for influencers, raised a $6.9M Series A from Felix Capital and HV Capital (TC)

Efabless, a startup helping non-hardware experts create integrated circuits, raised a $6.3M Series A-1 extension from GlobalFoundries, Synopsys, New North Ventures, and more (VC)

Bangladeshi edtech startup 10 Minute School raised a $5.5M pre-Series A led by Conjunction Capital (TC)

Aclid, a security and compliance automation platform for the biotech industry, raised a $3.3M seed round led by 2048 Ventures and IA Ventures (PRN)

Jam & Tea Studios, a multiplayer roleplaying video game studio, raised a $3.2M seed round led by London Venture Partners (BW)

Workflow automation platform Relay raised $3.1M in funding led by a16z (TC)

London-based AI startup TitanML raised a $2.8M pre-seed round led by Octopus Ventures (EU)

Goodhood, a subscription-based tech company for the auto maintenance and repair industry, raised a $2.6M seed round led by Bullish (FN)

Prevounce Health, a provider of remote care management software and devices, raised a $2.5M Series A led by Cloud Hill Partners (PRN)

CNaught, the first science-based and trust-centered seller of carbon credits, announced a $2.3M pre-seed round led by Greycroft (VC)

Fave, the app for superfans, raised a $2M round led by Warner Music, Sony Music, and the Female Founders Fund (TC)

IPO / Direct Listings / Issuances / Block Trades

Omani state energy firm OQ raised $749M in the IPO of a 49% stake in its gas pipelines business, marking Oman’s biggest listing on record; the IPO drew $10B in orders (BBG)

Debt

Bankruptcy / Restructuring

Several of RVL Pharmaceuticals’ operating subsidiaries are filing for bankruptcy in a prepackaged deal with lender Athyrium Capital and other key stakeholders (WSJ)

Fundraising

Hillhouse, an investment firm backed by Yale’s endowment fund, is preparing to pitch a new Asia-focused credit fund to international investors; the fund may reach $900M-$1.1B (BBG)

US VC Ankona Capital closed its second fund at $129M to invest in early growth-stage B2B software companies (FN)

SYN Ventures announced the first close of its dedicated cybersecurity seed fund at over $75M (FN)

US VC Alethia Venture Partners launched its $50M inaugural fund, Alethia Opportunity Fund I, to invest in the beverage industry (FN)

Boston PE firm BV Investment Partners raised a continuation fund that will allow it to maintain control of tax and accounting software provider Right Networks, which its $487M BVIP Fund VIII acquired in 2016 (WSJ)

Crypto Corner

Exec’s Picks

Two researchers independently discovered the first verifiable words in the Herculaneum papyri, ancient scrolls from Pompeii that were buried and carbonized by the Vesuvius eruption.

Retail investors love treasury bills, according to The Economist.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter