Together with

Good Morning,

Broadcom joined the trillion-dollar club, London is grappling with a historic stock market exodus, Databricks is nearing a record VC raise, Meta wants to stop OpenAI from going for-profit, and Citadel poached a second manager from Elliott's London office.

Specialized AI tools are emerging as the leaders for alternative investments workflows which is why BlueFlame AI is ahead of the curve. Check out their platform and how BlueFlame AI can serve your firm's specific needs!

Let's dive in.

Before The Bell

As 0f 12/13/2024 market close.

Markets

US stocks closed flat on Friday as investors awaited the Fed's final meeting of 2024

Dow fell for a seventh-straight day in its worst streak since Covid

Nasdaq rose for a fourth-straight week

US bond market selloff continued for a fifth-straight day

30Y yield rose 28 bps to 4.6% in its biggest weekly increase YTD

10Y yield gained 25 bps, exceeding 3M yield for the first time since 2022

China long-term yields continued to hit record lows

China-US 10Y spread hit -256 bps, the lowest since 2011

China-Japan 30Y spread is now at -24 bps

Oil jumped to a three-week high as Russia and Iran sanctions loom

Dollar is up 6.3% YTD on track for its best year since 2015

Bitcoin topped $106k for a new ATH in its longest weekly win streak since 2021

This week, we'll receive rate decisions from the Fed and BOJ

Earnings

What we're watching this week:

Wednesday: Micron, General Mills

Thursday: Nike, FedEx, CarMax, Accenture

Full calendar here

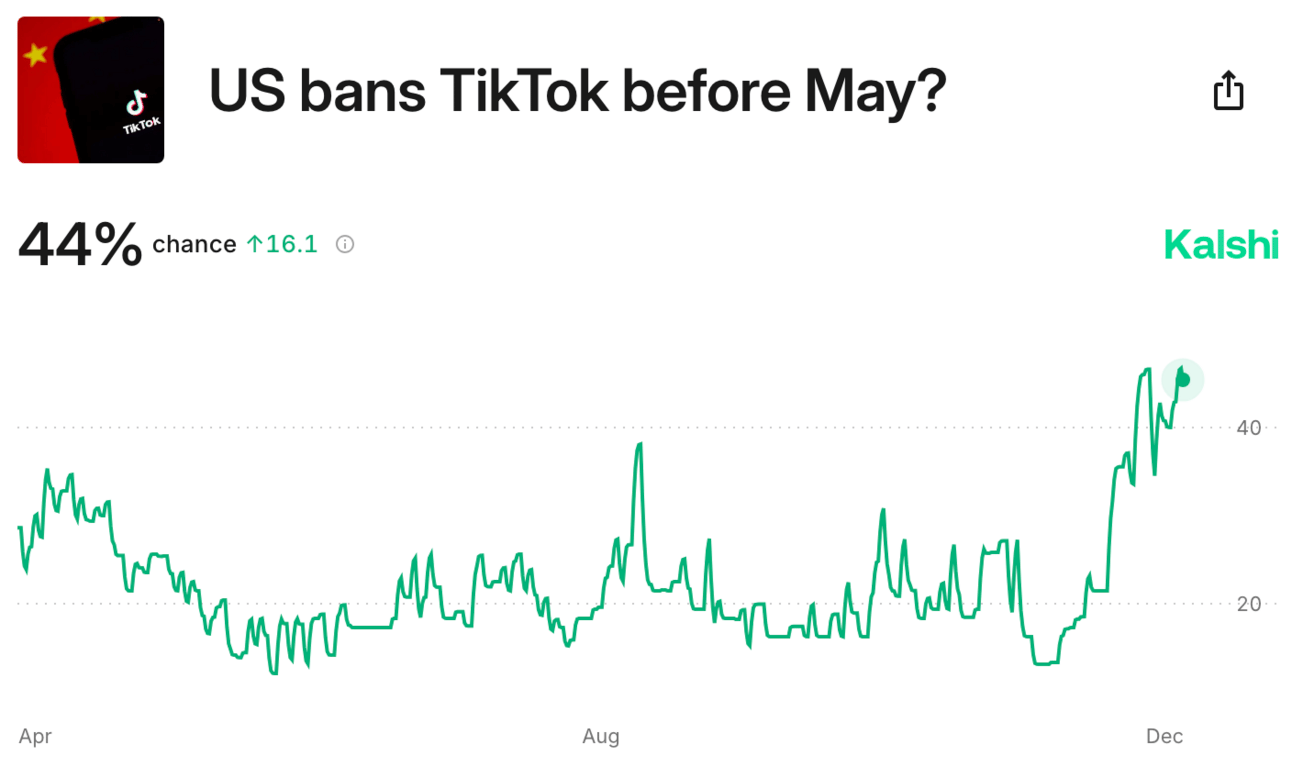

Prediction Markets

TikTok failed in a last ditch court effort to temporarily halt the looming January 2025 US ban, but Trump promised to "save TikTok." So what's next?

Headline Roundup

London Stock Exchange suffers biggest listing exodus since 2009 (FT)

Massive interest burden haunts $29T EM debt pile (BBG)

Canada will end 30% domestic stake limit to boost pension investment (BBG)

China consumption unexpectedly slowed (CNBC)

Asia bonds saw foreign outflows for first time in seven months (RT)

Hedge funds turn the most bullish on gas in eight months (BBG)

Philippine bond trading volume hit a record high (BBG)

Citadel poached a second manager from Elliott (FT)

Office CRE meltdown is starting to surface at regional banks (BBG)

Report finds BlackRock and others wary of joining climate initiative (RT)

Goldman received approval to sell funds in China (RT)

Private banks boost Hong Kong hiring to woo rich Chinese clients (BBG)

Broadcom becomes twelfth public company to hit $1T market cap (CNBC)

Cloud giants could get key role in gatekeeping foreign AI chip access (RT)

Meta urged California to stop OpenAI from becoming for-profit (WSJ)

CEOs want Trump to change course on tariffs (WSJ)

Trump's search for banking regulators impeded by talk of regulation cuts (FT)

Trump is considering privatizing USPS (WP)

US Treasury is split on Nippon-US Steel deal (FT)

Apple plans foldable iPhones to revive growth (WSJ)

Trafigura profits dropped to the lowest since Covid (FT)

J&J sued Cigna for draining its drug copay funds (WSJ)

Goldman and BofA will donate to Trump's inaugural committee (RT)

Porsche expects to write down its Volkswagen stake by 40% (FT)

The hunt of Assad dynasty's missing billions begins (WSJ)

A Message from BlueFlame

Key AI Adoption Lessons Learned from Alternative Investment Leaders in 2024

2024 was the year of planning for AI deployment in the alternative investments industry. Through discussions with firms around the globe, we gained valuable insights about AI implementation. Here are the critical lessons learned:

Specialized AI providers trump in-house development: Despite planning to build internal solutions, firms discovered that specialized AI providers offered faster deployment, stronger security, and industry-specific expertise.

Focused implementation drives success: Successful firms started with specific, high-impact use cases, including research analysis, email management, and document digitization.

Stakeholder buy-in is critical: Transparent communication and stakeholder engagement were essential. Success relied on identifying internal champions, providing comprehensive training, and addressing security concerns proactively.

Phased rollouts work best: The "big bang" approach to implementation rarely succeeded. Instead, firms found success through measured, phased deployments that allowed for testing, refinement, and gradual expansion of AI capabilities.

To help you assess your AI strategy and prepare for implementation, download our eBook, "Leveraging AI in Alternative Investment Management: Strategies for Implementation and Success."

Schedule a demo today to see how BlueFlame AI can work for your firm.

Deal Flow

M&A / Investments

Food maker Post Holdings is considering an acquisition of $11.3B-listed peer Lamb Weston

Italian lender UniCredit made a binding $10.5B buyout offer for rival Banco BPM

Blackstone, Bain Capital, and Japan's JIP are final bidders for Mitsubishi Chemical Group unit Mitsubishi Tanabe Pharma which could fetch a $3B-$3.5B valuation

Macquarie offered to buy Malaysian cellular firm Axiata's telecom infrastructure unit EDOTCO for $3.5B

$1.3B-listed Boston bank Berkshire Hills Bancorp and $1.1B-listed peer Brookline Bancorp are in talks to combine

Goldman Sachs Asset Management is nearing a deal to acquire Dutch generic drugmaker Synthon from BC Partners for $2.1B

PE billionaire Justin Ishbia is exploring a bid for $1.7B-valued MLB team Minnesota Twins

Stonepeak agreed to acquire Italian forged components manufacturer Forgital from Carlyle for over $1.6B

European insurer Allianz scrapped a proposed $1.6B acquisition of a 51% stake in Singapore's Income Insurance due to public backlash

Brand-management firm WHP Global is nearing a deal to acquire iconic wedding-dress maker Vera Wang, which was valued at $1.6B in 2023

German online retailer Zalando is planning an offer to buy smaller peer About You for $1.27B

Blackstone acquired Eastern European warehouse portfolio CT Real Estate for $495M from TPG Real Estate

UK chemicals group INEOS acquired the US assets of Chinese state energy giant CNOOC

Argentina will sell its 51% stake in state-owned grid operator Transener

VC

Data analytics software firm Databricks is nearing a $9.5B funding round at a $60B+ valuation led by Thrive Capital, a16z, Insight Partners, and GIC

AI startup Liquid AI raised a $250M Series A at a $2B+ valuation led by AMD

Security camera startup Verkada raised a $200M round at a $4.5B valuation led by General Catalyst

AI lending tech startup Zest AI raised a $200M growth round from Insight Partners

Consumer fintech banking platform Current raised a $200M round from a16z, Wellington Management, General Catalyst, and others

Spanish wellness tech platform bsport raised a $33M Series B led by Base10 Partners and Octopus Ventures

Swiss smart contract platform Waterfall Network raised $11.6M from Bolt Capital, Alpha Token Capital, and Enflux

Maisa, a Spanish AI deeptech startup, raised a $5M pre-seed round led by NFX

eyva.ai, an AI startup optimizing beauty and wellness product portfolios, raised a $3M seed round led by Earlybird and WENVEST Capital

IPO / Direct Listings / Issuances / Block Trades

Turkey energy firm Aydem Group is planning local IPOs for its GDZ Elektrik Dagitim and ADM Elektrik Dagitim units at potential $2.2B and $1.5B valuations respectively

Carlyle is considering a $1B India IPO of engineering services firm Quest Global

Indian retailer Vishal Mega Mart's $943M IPO drew $19B worth of bids

Chinese tea chain Sexy Tea is planning a US IPO over Hong Kong that could raise several hundred million dollars

Debt

Sixth Street agreed to buy up to $4B of consumer installment loans from BNPL lender Affirm

Databricks is seeking $4.5B of debt, including $2.5B in private credit, as part of its historic fundraise

Morgan Stanley is nearing a deal to acquire a $940M portfolio of Spanish mortgages from Banco Santander

Carlyle raised $318M in private credit from Ares, KKR, and UBS for its LBO of Australia's Waste Services Group from Livingbridge

Bankruptcy / Restructuring / Distressed

Sri Lanka bondholders backed the country's $12.6B debt restructuring

Party City's potential second bankruptcy will close all its stores

Fundraising

G2 Venture Partners is seeking to raise $750M for its third fund

Crypto Corner

WSJ published the updated opinions of five of the biggest Wall Street titans who once thought Bitcoin was a fad.

MicroStrategy and Palantir joined the Nasdaq 100 index (BBG)

Exec’s Picks

A good night's sleep sets the tone for the rest of your day, and Eight Sleep's Pod will have you sleeping like a baby. The Pod, which fits on any bed, uses machine learning to analyze your health while you sleep and automatically optimizes your body temperature and breathing throughout the night to have you waking up sharper, energetic, and fully rested from day one. Use code LIT to get $350 off your Eight Sleep Pod.

OpenAI seemingly exposed Elon Musk for his 'for-profit' hypocrisy, including his own well-documented desire to go for-profit and gain full control of the company.

FT published a profile on David Sacks, the 'PayPal mafia' who recently became Trump's AI and crypto czar.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.