Together with

Good Morning,

Delaware reinstated Musk's $150B Tesla pay package, Bridgewater will expand ownership to 60% of employees, macro hedge funds had their best year since 2008, private credit stocks are down bad, and Bill Ackman wants to take SpaceX public via SPARC.

Stavtar has created a new class of software for the Office of the CFO, revolutionizing business spend and expense allocation for complex businesses, as well as compensation and organizational management. Check it out.

Let's dive in.

Before The Bell

As of 12/19/2025 market close.

Learn more about the Litquidity portfolios and subscribe to the strategies on Autopilot.*

Markets

US stocks rose on Friday as the AI trade regained its footing

UK's FTSE 100 rose to a near ATH

Europe's Stoxx 600 hit an ATH

Canada's TSX index hit an ATH

US Treasuries posted their first weekly gain since November

India stock market volatility fell to an all-time low

India's stock market is currently the calmest in the world

Copper rose to $12k/ton closer to its July ATH

Tin hit a three-year high after rallying 50% YTD

Earnings

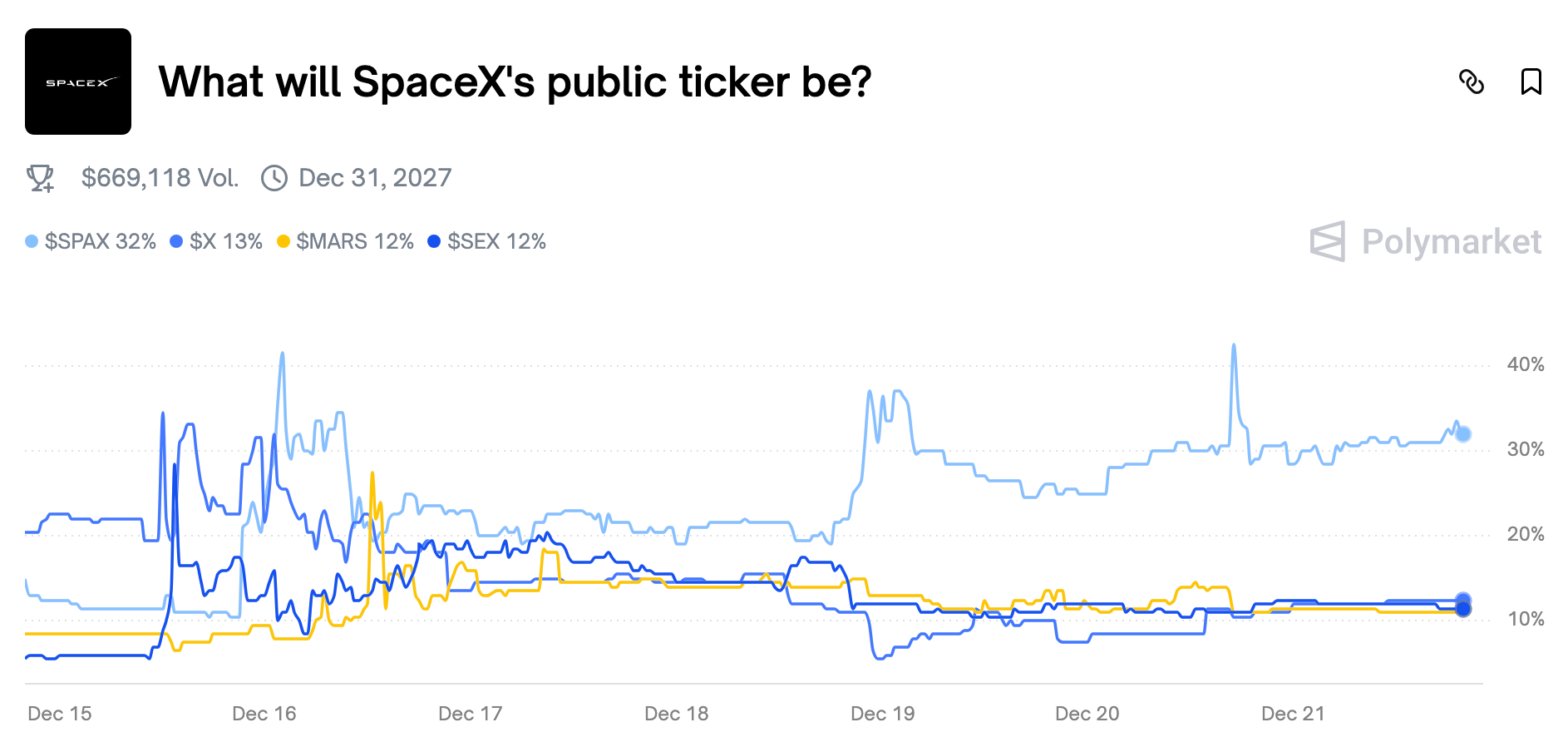

Prediction Markets

"The most entertaining outcome is the most likely." -Elon Musk

Track and trade live odds on Polymarket.

Headline Roundup

Fed chair-favorite Hassett says Trump is right about inflation (RT)

FOMO versus bubble angst signals more stock volatility in 2026 (BBG)

Japan CPI rose 2.9% YoY, above target for a 44th straight-month (CNBC)

PBOC kept benchmark rates steady for a seventh-straight month (CNBC)

ECB warned banks against excessive use of SRTs (FT)

AustralianSuper will cut global stocks allocation on AI concerns (FT)

Macro hedge funds are up 16% YoY for their best year since 2008 (FT)

Citadel is up 9.3% YTD for its worst year since 2018 (BBG)

Bridgewater expands equity ownership for employees after blowout year (RT)

BDC stocks are negative YTD with many trading below NAV (WSJ)

'Marvelous' EM is set for another star showing in 2026 (RT)

China CSI index ETF inflows surged to a record high (BBG)

Gold and silver funds shine in year of record highs (FT)

Foreign buyers snap up cheap UK companies as dealmaking hits record (FT)

Record $350B deals boom fuels upbeat M&A outlook in Japan (BBG)

Data center deals hit a record $61B this year amid construction frenzy (CNBC)

Big VCs raise billions while overall industry fundraising sags (NC)

BofA IB bonuses will jump this year (RT)

Fidelity pledged crackdown on excessive corporate pay (FT)

Musk won appeal to reinstate his $56B ($140B) Tesla pay package (CNBC)

Musk's net worth touched $750B (RT)

20% of Google AI SWE hires in 2025 were ex-employees (CNBC)

Job market woes are expected to continue next year (BBG)

US pitches 'Project Sunrise' plan to turn Gaza into high-tech metropolis (WSJ)

CFTC awarded two whistleblowers over $1.8M (BBG)

US released the Epstein files (CNBC)

A Message from Stavtar

Stavtar has built the universe of software for complex businesses to live in, bringing together StavPay, StavComp, StavOrg and StavMarket in one platform.

More than 120 managers with over $2.4T of AUM collectively rely on Stavtar to manage their vendors, contracts, invoices, expense allocations, payments, legal entities, compensation, and connect to vendors in the Stavtar community.

Get more details at stavtar.com and schedule a demo today.

We promise you, it's an hour well spent.

Deal Flow

M&A / Investments

New Mountain Capital president Matt Holt will leave the firm to launch healthcare tech platform Thoreau to buy and rollup Datavant, Swoop, Machinify, Smarter Technologies, and Office Ally from New Mountain Capital in a $30B deal

A consortium led by PE firms Permira and Warburg Pincus will take-private financial services software maker Clearwater Analytics at an $8.4B valuation, including debt, at a 10% premium

BioMarin Pharmaceutical agreed to buy Amicus Therapeutics in a $4.8B all-cash deal at a 33% premium

Japanese bank MUFG agreed to acquire a 20% stake in Indian shadow lender Shriram Finance for $4.4B

KKR emerged as the frontrunner to acquire $3.5B-listed Japanese chemical manufacturer Taiyo

Chinese PE firm HSG agreed to acquire Italian luxury sneaker maker Golden Goose from UK PE firm Permira at a $3B valuation

Bain Capital-backed foods supplier Cuisine Solutions is exploring a sale at an over $2B valuation

KKR agreed to acquire a 45% stake in hair care brand Wella from beauty products giant Coty for $750M cash

Japanese tech conglomerate Sony raised its stake in comic strip producer Peanuts from 40% to a controlling 80% for $450M

Japan PE firm Unison Capital agreed to acquire Krispy Kreme's Japan operations for $65M cash

UK PE firm Bridgepoint Group will absorb the $4.3B secondaries team of secondaries specialist Newbury Partners

Singapore food delivery firm Grab acquired Chinese AI and robotics firm Infermove

VC

SoftBank is racing to close a $22.5B funding commitment to OpenAI by year-end through an array of cash-raising schemes, including a sale of some investments and margin loans against its stake in chip firm Arm

Autonomous SRE startup Resolve AI raised a Series A at a $1B valuation led by Lightspeed Venture Partners

Neurable, an everyday brain-computer interface startup, raised a $35M Series A led by Spectrum Moonshot Fund

AI red-teaming cybersecurity startup Armadin raised a $24M seed round from Ballistic Ventures

Nawah Scientific, an Egyptian cloud-lab life-science company, raised a $23M Series A round led by Life Ventures

Stablecoin-focused neobank Kontigo raised a $20M seed round

AI prospecting platform Finny raised a $17M Series A led by Venrock

ETHGas, an Ethereum blockspace futures marketplace, raised a $12M seed round led by Polychain Capital

Voice AI dating app Known raised a $9.7M seed round led by Forerunner Ventures and NFX

Automotus, a curb-management computer-vision startup, raised a $9M round from Santa Barbara Venture Partners, Weatherford Capital, Techstars, and others

Magma, an AI-native sovereign cloud startup, raised an $8M Series A led by General Catalyst

Get real-time updates on any startup, VC, or sector on Fundable.

IPO / Direct Listings / Issuances / Block Trades

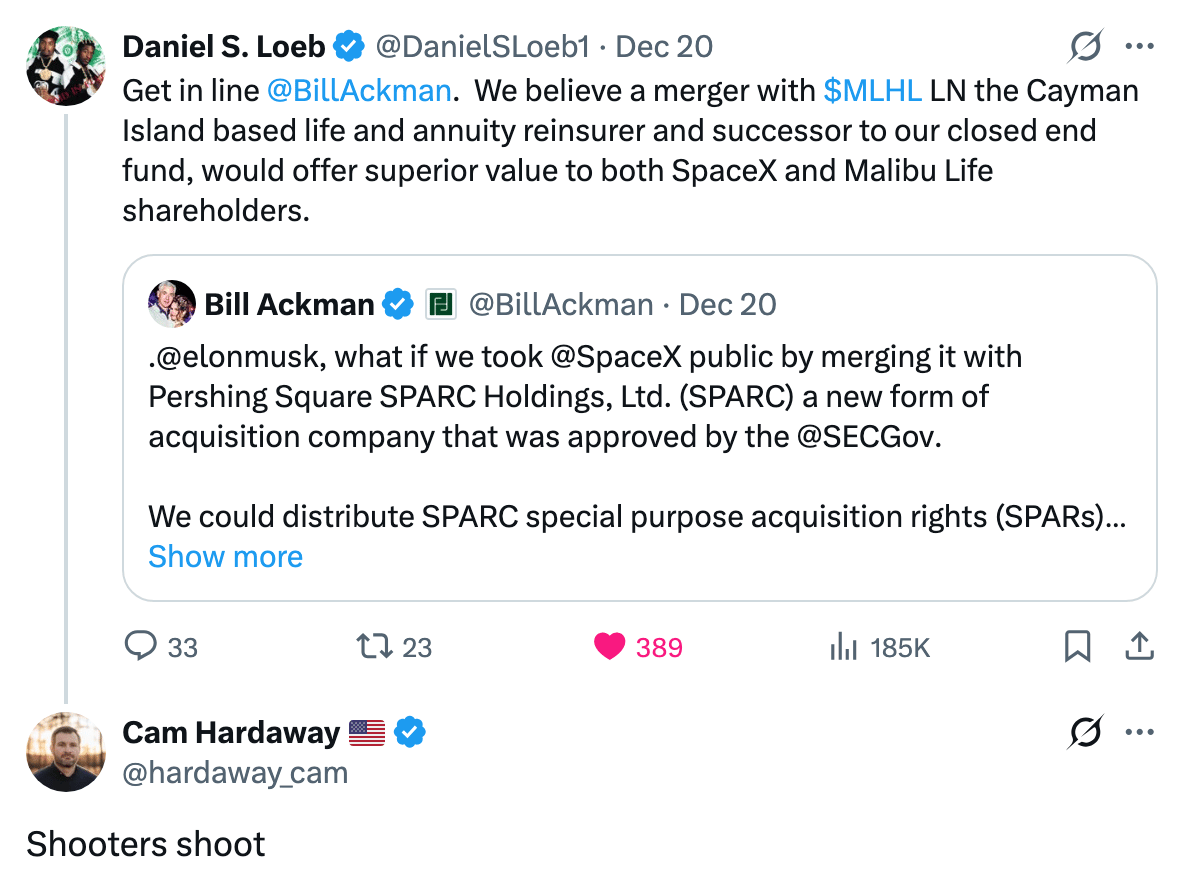

Morgan Stanley is emerging as a frontrunner to lead SpaceX's IPO

Sunway Healthcare, the healthcare arm of Malaysian conglomerate Sunway, is seeking to raise $700M in a Malaysia IPO

Medtech Medtronic's diabetes management unit MiniMed filed for a US IPO

Singapore-based holding company GLP selected banks for a 2026 Hong Kong IPO

Indian digital health platform Practo is in talks with banks for a 2026 IPO

Japan's Seven & i is pressing its 7-Eleven US business to deliver a faster turnaround as Seven & i seeks to IPO the unit

Advisors recommended European fintech SumUp Payments to IPO locally instead of US

Adani Airports, the airports unit of Indian conglomerate Adani, is seeking a partner ahead of an IPO as it plans $11B in investments by 2030

SPAC / SPARC

Bill Ackman's hedge fund Pershing Square proposed merging SpaceX with Pershing Square SPARC Holdings, a special purpose acquisition rights vehicle that would give Tesla shareholders priority access to invest in SpaceX

Debt

Colombia sold a record $6B in peso bonds directly to a foreign investor

Uganda's state-owned oil firm UNOC secured a $2B loan from Vitol Bahrain

Bankruptcy / Restructuring / Distressed

Chinese EV marker Geely's Sweden unit agreed to convert $300M of EV maker Polestar's debt into equity and lend $600M amid losses and liquidity woes

Bankrupt subprime auto lender Tricolor won court approval to auction 9.5k vehicles acquired for $125M, with proceeds held pending a creditor agreement on distribution

JPMorgan questioned subprime auto lender Tricolor's accounting a year before its collapse where Tricolor execs sought inspiration from Enron to hide fraud

Activist hedge fund Elliott convinced a court to liquidate PE firm Stronghold's O&G fund after it breached a settlement by missing asset sale deadlines

Nonprofit fundraising platform Flipcause filed for Chapter 11 bankruptcy weeks after California ordered it to cease operations over delayed donation transfers to charities

A shareholder sued fast-food chain Fatburger and Johnny Rockets-owner FAT Brands for hiding debt and misrepresenting it as cash to secure financing amid a looming bankruptcy

New Fortress Energy reached forbearance agreements with creditors after missing interest payments and signaled it won't make year-end principal payments

Peruvian state-owned driller Petroperu's bonds fell to 64¢ to a two-year low on reports Peru is considering bankruptcy for the firm

PIMCO and developer Witkoff Group defaulted on a $400M+ loan tied to a Santa Monica luxury apartment complex

Fundraising / Secondaries

PE firm Golden Gate Capital is seeking $1.5B in a tender offer from Ardian, Neuberger Berman and Apollo's S3 Partners for a secondaries deal to let some LPs cash out of its evergreen fund and another $300M for a new PE fund

Point72 PM Alex Silverstein will spinoff his pod into healthcare-focused hedge fund Sirenia, including over $200M in AUM from Point72

Crypto Sum Snapshot

Investors are diversifying crypto bets

Coinbase sued three US states over prediction market regulation

Strategy and Bitcoin-buying firms face wider exclusion from stock indexes

Crypto hedge funds had their worst year since 2022 with most negative

Crypto Sum compiles the most important stories on everything crypto. Read it here.

Exec’s Picks

Has AI reduced the workload in M&A – or just moved it around? Read UpSlide's 'The AI Paradox in M&A' report to discover the truth from M&A professionals across the US and UK.

ICYMI: We curated a last-minute gift guide of the perfect gifts you can buy for loved ones if you've been procrastinating your Christmas shopping. Get it here.

Here's what S&P 500 year-end targets of Wall Street strategists looked like at different points of the year.

PE lawyer Shahrukh Khan wrote a fantastic piece on why LPs don't typically sue GPs.

FT did a deep dive into Trump's mass pardoning spree.

WSJ did a profile on Xavier Majic, the Canadian hockey star-turned-hedge fund manager whose fund is making a killing on AI.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always, be smart out there. Litquidity is compensated to promote AutoPilot. Compensation details available upon request.