Together with

Good Morning,

Andreessen Horowitz is setting up shop in London, the US is allowing South Korean and Taiwan chipmakers to continue operating in China, JPMorgan had a 9-figure Epstein settlement, SoftBank is preparing for more layoffs, Reddit communities are protesting against their CEO, and the Nuggets won the NBA Finals.

Looking for a resilient asset class to diversify your portfolio? You can invest directly in farmland through today’s sponsor, AcreTrader.

Let’s dive in.

Before The Bell

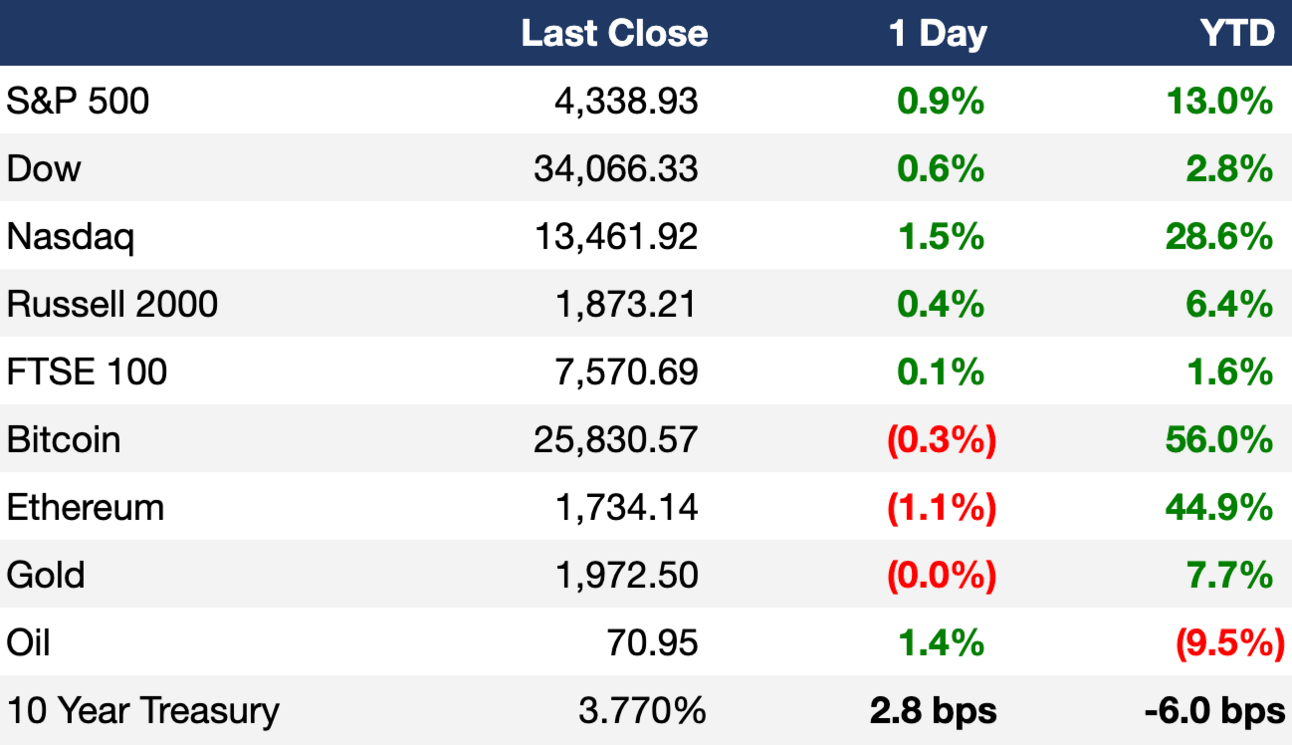

As of 6/12/2023 market close.

Markets

Stocks rallied to kick off a busy week for economic news with inflation data out early Tuesday and the Federal Reserve's next policy decision set for release Wednesday afternoon

All three major indexes closed higher, with the Nasdaq rising 1.53% and continuing a streak of seven-straight winning weeks

Both the S&P 500 and the Nasdaq rallied on Monday to their hit their highest closing levels since April 2022

China's yuan extended losses to trade at its lowest level against the dollar since November as recent data has raised expectations for monetary easing from the People's Bank of China this year

Gold prices were subdued, down about 0.3% to $1,970, pressured by a moderate rise in U.S. Treasury yields and market caution

Oil prices settled down 4% on jitters ahead of US Fed meeting

Earnings

Oracle beat Q4 expectations as the company’s top source of revenue, cloud services and license support, jumped 23% to $9.7B, but revenue from cloud licenses and on-premises declined 15% to $2.15B; shares climbed ~4% AH (CNBC)

What we're watching this week:

Today: Iteris

Wednesday: Lennar

Thursday: Ammo

Friday: Adobe, Kroger, Jabil

Full calendar here

Headline Roundup

US to allow South Korean, Taiwan chip makers to keep operations in China (WSJ)

EV charger makers guardedly look to adopt Tesla standard (RT)

JPMorgan to pay $290M to settle Jeffrey Epstein accusers’ suit (WSJ)

Oreo-maker Mondelez faces Nordic backlash over Russia business (RT)

Grubhub to lay off about 15% of staff (WSJ)

Britain’s post-Brexit policy drift alarms world’s executives (BBG)

SoftBank prepares for a new round of layoffs at Vision Fund (RT)

China's Nio cuts prices, ends free battery swapping as sales slide (RT)

Amazon is using generative AI to summarize product reviews (CNBC)

Reddit communities go dark in protest against CEO and developer fees (WSJ)

Lockheed Martin collaborates with GlobalFoundries to secure defense chip supply (RT)

Verizon searching for new finance chief and potential CEO successor (WSJ)

Jokić, Nuggets beat Miami Heat to win the NBA title (ESPN)

A Message From AcreTrader

Farming for investment returns?

Land investments have historically consistent return opportunities for decades, even during high inflation and market downturns.

With productive land, you could earn income two ways. The first is from the annual income that may be generated through rent payments, timber harvests, or revenue share with the farmer. The second, on the potential appreciation of the land once the investment is sold.

Diversify your portfolio with farmland investments to help navigate economic headwinds.

*AcreTrader Financial, LLC, member FINRA/SIPC. Farmland investing is speculative and involves high degree of risk, including complete loss of principal and not suitable for all investors. Past performance does not guarantee future results and there is no guarantee this trend will continue.

Deal Flow

M&A / Investments

The FTC has sued Microsoft in US federal court to block the closing of its $69B acquisition of Activision Blizzard (BBG)

Broadcom is set to gain conditional EU antitrust approval for its proposed $61B acquisition of cloud computing firm VMware (RT)

Nasdaq agreed to buy Thoma Bravo-owned risk management and regulatory software firm Adenza for $10.5B (RT)

Novartis agreed to acquire US biotech firm Chinook Therapeutics for up to $3.5B cash (RT)

UBS completed its $3.4B acquisition of Credit Suisse (RT)

Brookfield Renewable is buying Duke Energy’s unregulated utility scale Commercial Renewables business in a $2.8B deal (RT)

Swiss industrial group Georg Fischer made a $2.3B bid for plumbing and heating systems maker Uponor, 12% higher than rival Aliaxis’ bid (RT)

Oil field service companies NexTier Oilfield Solutions and Patterson-UTI Energy, which have market caps of ~$2B and $2.2B respectively, are holding talks over a possible merger (WSJ)

Brazilian chlorine and soda producer Unipar Carbocloro offered conglomerate Novonor $2B cash for a 34.4% stake in Brazilian petrochemical firm Braskem (RT)

France's Antin Infrastructure made a tender offer worth $931M to buy 100% of Spanish renewable company Opdenergy (RT)

Cofounder Rakesh GangwalInter’s family is selling a 5-8% stake in InterGlobe Aviation, the parent company of Indian airline IndiGo, worth up to $910M (RT)

Morgan Stanley Infrastructure Partners is buying Sacyr’s waste management unit Valoriza Servicios Medioambientales in a $789M deal (RT)

Kevin’s Natural Foods, a refrigerated entrée seller backed by investment firm Towerbrook Capital, is exploring a sale and seeking a valuation of $700M-$800M (BBG)

French builder Eiffage took full control of the Millau Viaduct toll bridge after purchasing the remaining 49% stake from French state-owned Caisse des Depots et Consignations for $255M (BBG)

British sportswear retailer Frasers Group forged a strategic partnership with electrical retailer AO World after buying a 18.9% stake in the company from Odey Asset Management for $94M (RT)

A group of investors including former CEO Maseko’s Afrifund, Axian Telecom, and Public Investment Corp bid for a controlling stake in South African telecom company Telkom (BBG)

VC

Ophthalmic gene therapy startup Beacon Therapeutics raised a $120M round led by Syncona (FN)

Industrial drone startup Percepto raised a $67M Series C with $50M in equity and $16M in debt led by Koch Disruptive Technologies (TC)

AI efficiency platform Granica raised a $45M round led by NEA and Bain Capital Ventures (FN)

CloudZero, a cloud cost intelligence platform, raised a $32M Series B led by Innovius Capital and Threshold Ventures (PRN)

Metabolic diseases startup Eccogene raised a $25M Series B led by New Alliance Capital and Zhangjiang Healthcare Venture Capital (PRN)

Djust, a French B2B commerce platform, raised a $13M round led by NEA (TC)

At-home fertility testing startup Oova raised a $10.3M Series A led by Spero Ventures (TC)

Rex, a photo-based recommendations app, raised $4M in funding led by Accel (FN)

Nigerian communications platform-as-a-service startup Termii raised a $3.7M round led by Ventures Platform (TC)

Avatar platform Hyper raised a $3.6M seed round led by Two Sigma Ventures (TC)

Clean energy startup tem. raised a $2.7M seed round led by AlbionVC (FN)

Ironforge, a Solana development platform, raised a $2.6M pre-seed round led by Reciprocal Ventures (PRN)

Pyrra Technologies, an AI security platform that identifies threats across alternative social media, raised a $2.3M seed round led by Ducera Investments (BW)

Anise Health, a New York-based culturally-responsive digital mental health company, raised a $1.2M pre-seed round led by Kicker Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

Mediterranean restaurant chain operator Cava Group raised its IPO valuation target to $2.23B (RT)

Thyssenkrupp is looking to raise $537M-$646M in the IPO of its hydrogen unit Nucera (BBG)

Asian renewable energy platform Athein is looking to raise between $250M-$300M in equity to fund solar and wind projects in Southeast Asia (RT)

SPAC

X-energy Reactor, a nuclear fuel and reactor engineering company merging with Ares Acquisition Corp, lowered its deal value from $2.1B to $1.8B (RT)

ACG Acquisition Company is buying two Brazilian nickel and copper mines from PE firm Appian Capital in a $1B deal; Glencore, Stellantis, and Volkswagen's battery unit PowerCo are backing the deal (RT)

Automotive software company LeddarTech is going public through a reverse merger with Prospector Capital at a $348M equity value (BBG)

Debt

Nasdaq secured a $5.7B bridge loan to help finance its $10.7B acquisition of Adenza (BBG)

The US Energy Department will loan KORE Power $850M to develop an advanced battery cell manufacturing facility in Arizona (RT)

The European Bank for Reconstruction and Development will provide a $215M loan to Ukrainian state railway company Ukrzaliznytsya to improve links to the EU (RT)

Chinese property developer Dalian Wanda is seeking to postpone repayment if its mall IPO fails this year (BBG)

Bankruptcy / Restructuring

Instant Brands, the maker of Pyrex kitchenware, filed for Chapter 11 bankruptcy due to its heavy debt load and the impact of high interest rates (RT)

The Center for Autism and Related Disorders, a Blackstone-owned operator of 130 treatment centers in the US, filed for Chapter 11 bankruptcy, and its founder, Dr. Doreen Granpeesheh, has made a $25M offer to repurchase the company (RT)

Fundraising

Salesforce doubled its venture capital fund for generative AI startups to $500M (RT)

Crypto Corner

US VC firm and major crypto investor Andreessen Horowitz is opening its first international office in London to support the development of blockchain technologies and startups (RT)

Binance.US says the asset freeze sought by the SEC will cripple its business (BBG)

Bank of China’s investment bank subsidiary BOCI became the first Chinese financial institution to issue a tokenized security in Hong Kong after it issued $28M worth of digital structured notes minted on the Ethereum blockchain (CT)

US House of Representative members have introduced a proposal to restructure the SEC and fire chair Gary Gensler (CT)

Exec’s Picks

Packy McCormick wrote a detailed piece on Varda and their ambitious goal of dominating the manufacturing industry… in space.

Colby Smith covered the Fed’s waiting game with high inflation, and whether the US economy is beginning to crack, in this Financial Times piece.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter