Together with

Good Morning,

It was a quite uneventful day in markets, besides maybe the totally unsurprising news of Kim Kardashian no longer managing her SKKY Partners PE firm.

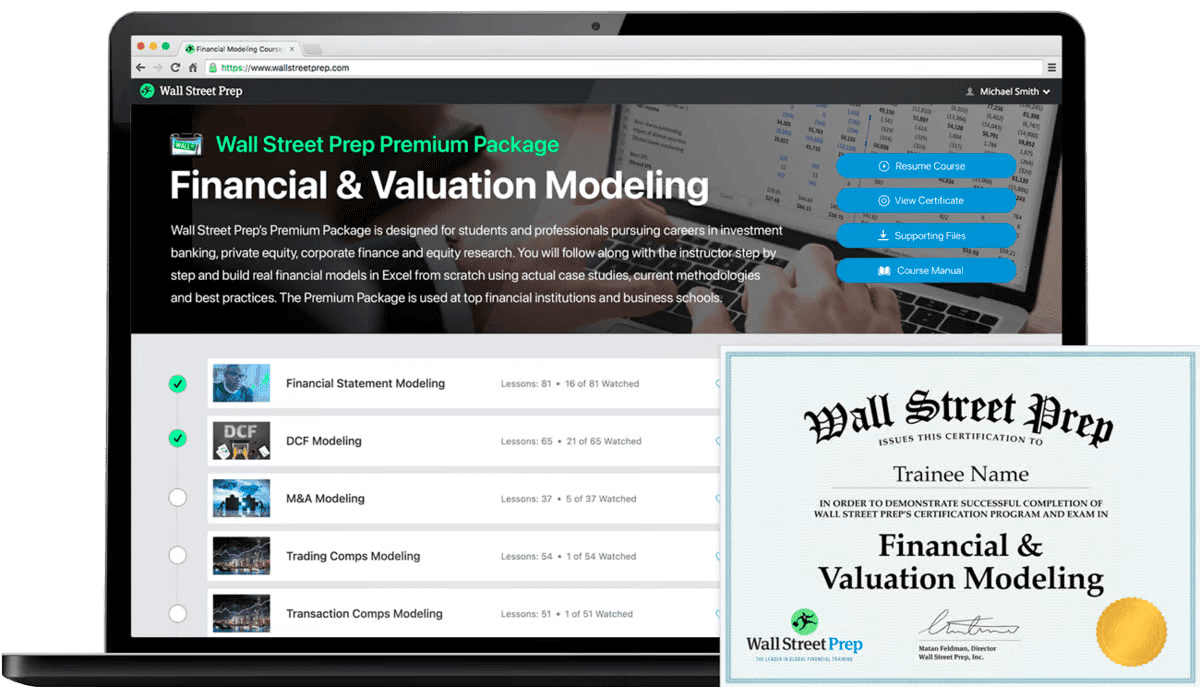

Looking to finally land that IB job next year? Check out Wall Street Prep for the financial modeling course used by major investment banks to train their their analyst / associate classes!

Let's dive in.

Before The Bell

As of 12/26/2024 market close.

Markets

US stocks closed flat in a light trading session yesterday after a strong start to the holiday week

Dow rose for a fifth-straight day

US 10Y yield hit the highest since May

Dollar hit a five-month high versus yen

Rolex watch prices index hit its lowest since November 2020, down 31% from its peak in March 2022

Earnings

Full calendar here

Prediction Markets

Twitter is absolutely losing it over the topic of legal / high-skill immigration, tech hiring, and some racism-fueled political sentiment.

Headline Roundup

Unemployment continuing claims hit a three-year high (RT)

Kim Kardashian is no longer managing her PE firm SKKY Partners (AX)

BlackRock wrote down the value of a flagship renewable fund (BBG)

BNY Mellon revives two-week 'recharge period' for employees (YH)

SOFR jumped to 4.4% despite Fed repo rate tweak (BBG)

India roars ahead of China to top Asian IPO rankings (FT)

Germany's own 'magnificent seven' helps DAX defy bleak growth outlook (FT)

Argentina's Milei is driving the hedge fund trade of the year (WSJ)

ESG funds have $1.4B exposure to China labor camps (FT)

China EV sales set to overtake gas cars years ahead of west (FT)

Argentina sold the most FX reserves since 2019 on importer demand (BBG)

New York will fine fossil fuel companies $75B under new climate law (RT)

Former Citigroup chairman Richard Parsons passed away (CNBC)

Officials accused Russia in deadly Azerbaijan passenger plane crash (WSJ)

Young Canadians are ditching hockey for basketball and soccer (FT)

London exodus slowed to the lowest since 2013 (FT)

A Message from Wall Street Prep

Don't Blow Your Dream IB Interview

Finance nightmare, a short story:

Target undergraduate school. 4.0 GPA. Great extracurriculars. Tons of opportunities for the new year.

You're set. Your job is a lock and you're breezing through the interviews. The end is in sight, as long as you crush the case study. You're well on your way... until you can't remember how to run a DCF model.

And just like that, everything falls apart.

Game over. Have fun with the back office gig.

If you don't want to be a back-office guy, make sure you stick the interview by using Wall Street Prep.

Wall Street Prep offers a complete financial and valuation modeling training program, so you can learn financial statement, DCF, trading and transaction comps, M&A and LBO modeling. This is the same program used by top investment banks and financial institutions to train their juniors.

Take 20% off with code HOLIDAY20 till December 31st and ace those interviews for 2025 🚀 💻 🤝

Deal Flow

M&A / Investments

Japanese electric motor maker Nidec made a $1.6B unsolicited takeover offer for industrial gear supplier Makino Milling Machine

NeueHealth's largest shareholder New Enterprise Associates and a group of existing investors will take the healthcare provider private in a $1.3B deal, including debt

Martin Midstream Partners terminated a $157M merger deal with Martin Resource Management

US PE firm Altaris will acquire Chinese pharma company WuXi AppTec's gene therapy manufacturing unit WuXi Advanced Therapies due to US national security restrictions

VC

Cloud-based bank platform Infinant raised a $15M Series A led by FINTOP Capital and JAM FINTOP BankTech

Performance planning platform Una Software raised a $5.6M round

Caruso, a New Zealand-based software solutions for private market fund management, raised $3.2M in strategic funding led by Balmain

IPO / Direct Listings / Issuances / Block Trades

Chinese battery giant CATL will seek a second Hong Kong listing

Heating systems supplier Zhejiang Sanhua Intelligent Controls is preparing a second Hong Kong listing that could raise over $500M

Nigeria's biggest lender Access Bank raised $228M in a rights offer

Bankruptcy / Restructuring / Distressed

Struggling German air taxi firm Lilium agreed to sell the operating assets of its main subsidiaries to Mobile Uplift to restart operations following insolvency

Crypto Sum Snapshot

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.