Together with

Good Morning,

TikTok is prepping a US copy of its algorithm, China is weighing a record fine for PwC, global fund launches in China hit a record high, WeWork was cleared to exit bankruptcy, and Trump was convicted on felony charges in a historic first.

With yet another misguided banking policy being pushed in Congress, The Points Guy explains why your credit card rewards and points are at threat of further decimation. Read more below.

Let’s dive in.

Before The Bell

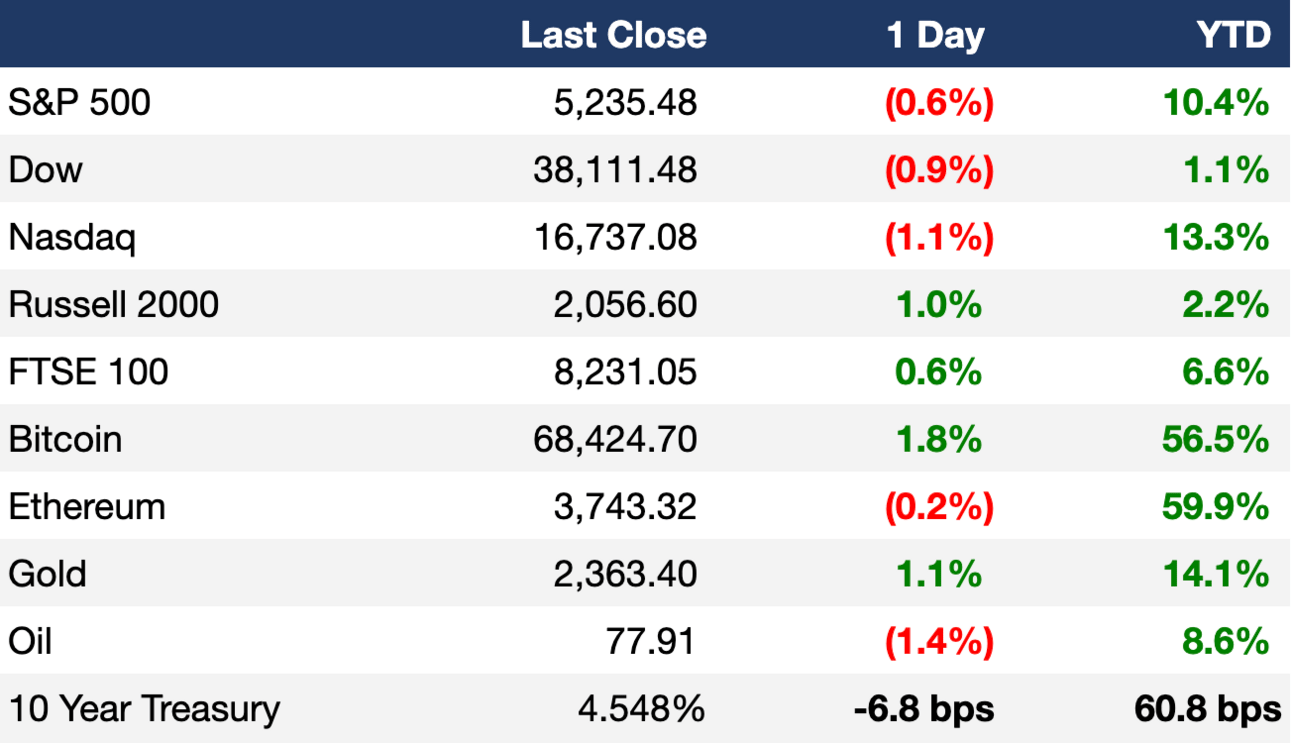

As of 05/30/2024 market close.

Markets

US stocks fell yesterday as investors reacted to economic data hinting at a slowing economy

Markets also braced for crucial inflation data due today

Earnings

Costco beat Q3 EPS and revenue estimate on a 6.5% jump in same-store sales driven by its growing international business (YF)

Dell plummeted 20%+ despite reporting better-than-expected Q1 EPS and revenue as growth in its AI server business was not enough to please investors (YF)

Dollar General fell ~8% despite beating Q1 earnings estimate due to a softer-than-expected profit forecast as customers remain price sensitive this year (YF)

Kohl's plunged ~23% after posting a surprise Q1 loss, missing on revenue, and lowering guidance as its turnaround remains slow to materialize (CNBC)

MongoDB plunged ~24% despite beating Q1 EPS estimates due to light Q2 guidance and a lowered FY forecast on low client demand (CNBC)

Full calendar here

Headline Roundup

TikTok is reportedly preparing a US copy of its core algorithm (RT)

Citadel Securities hired ex-Goldman exec Jim Esposito as president (FT)

Global fund launches in China hit a record high (RT)

China is weighing a record $138M fine for PwC (BBG)

BofA CEO expects 10%-15% jump in IB fees in Q2 (RT)

Zero-down mortgages are making a comeback (CNN)

UBS shakes up management to prepare for CEO succession (RT)

US GDP data was revised downwards on soft consumer spending (BBG)

Eurozone unemployment hit a record low (WSJ)

US issued guidelines for voluntary carbon market (WSJ)

Sustainability-linked bonds falter amid credibility concerns (FT)

June to see highest global sovereign debt issuances YTD (RT)

Foreigners pull money from EM portfolios after five months of inflows (RT)

US is slowing AI chip exports to Middle East (BBG)

US expansion worsens credit losses at Klarna (FT)

Future energy demand does not need new fossil fuels (FT)

Americans still prefer gas vehicles over hybrid or EVs (RT)

US pending home sales see largest drop in three years (RT)

Walmart managers are making over $500k/year (BBG)

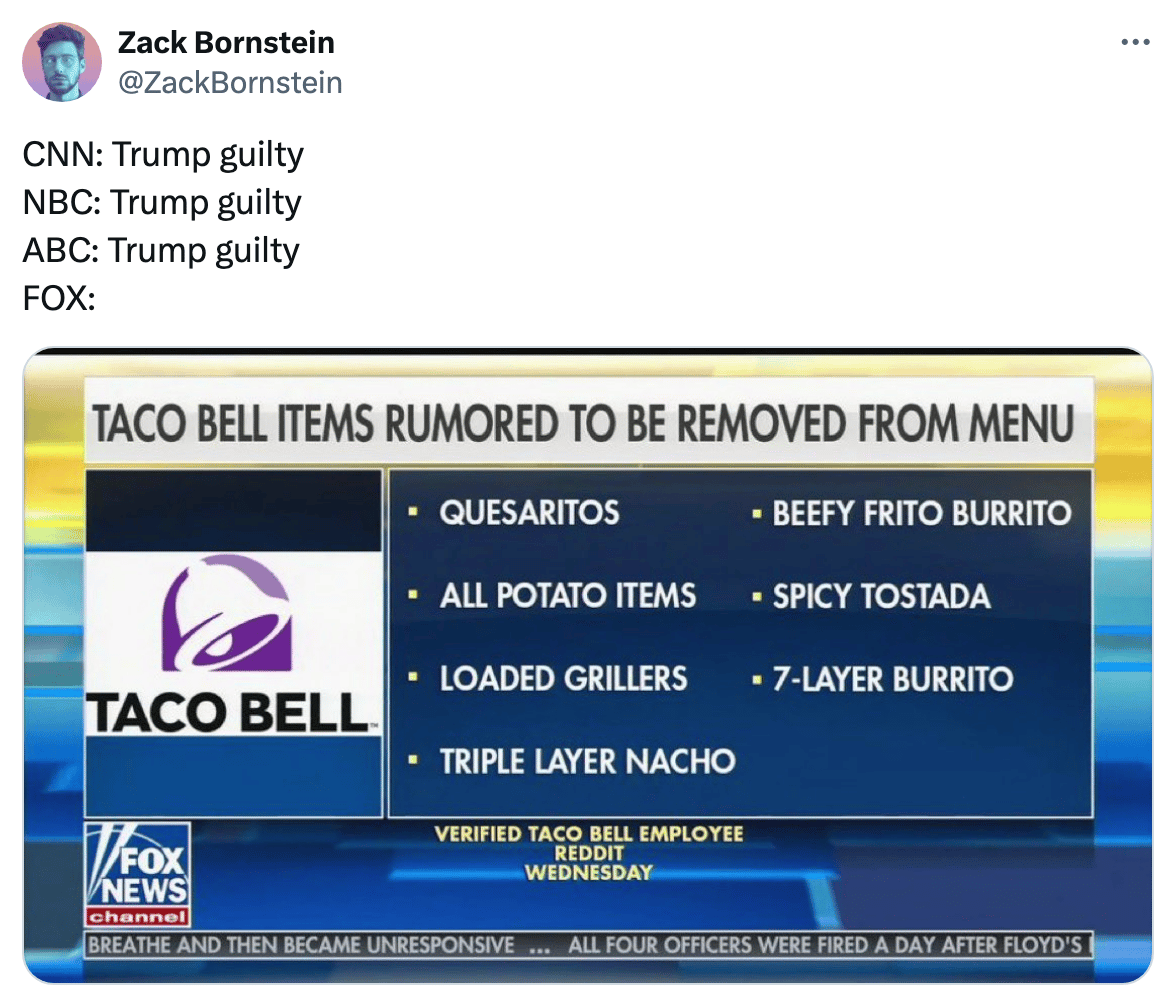

Trump becomes first former US president to be convicted of felonies (CNBC)

A Message From The Points Guy

The Durbin Amendment of 2010 virtually wiped out debit card rewards overnight...and a perpetually misguided Congress is pushing repeat legislation to now encroach on your credit card points and rewards.

Under the guise of competition, the Credit Card Competition Act will allow corporate megastores to process your spending on cheaper payment networks, which could eliminate incentive for your favorite credit card issuers to reward your spending with points.

A slew of research shows similar legislation in the Durbin Amendment not only failed to reduce debit card swipe fees, but effectively ended means by which banks would reward our debit spends with points.

And with repeat legislation being pushed again, the CCCA all but guarantees retailers to now also pocket your credit card swipe fees, and eliminate the benefits associated with your favorite credit cards...

...practically carving you out of your preferred network to earn you:

fewer points 🔻

higher fees 📈

fewer rewards 🔻

Find out why the CCCA is a recipe for fewer points, higher fees, and fewer rewards and what you can do to protect your points.

Deal Flow

M&A / Investments

KKR secured unconditional EU approval for its $24B acquisition of Telecom Italia's fixed-line network (RT)

David Ellison’s SkyDance Media sweetened its offer for $8.2B Paramount Global (BBG)

Brookfield is in exclusive talks to acquire a 53.3% stake in French renewable energy developer Neoen at a $6.6B valuation (BBG)

Amazon will increase its 4% stake in food delivery app GrubHub to ~18% and allow US users to order directly on Amazon’s website/app (BBG)

Red Bull agreed to take a minority stake in Leeds United FC as part of a kit sponsorship deal (BBG)

VC

Syre, a Swedish textile impact company, raised a $100M Series A led by TPG Rise Climate (FN)

Babylon, a startup building a Bitcoin-secured decentralized world, raised a $70M round led by Paradigm (VC)

Romanian fintech FintechOS raised a $60M Series B led by Molten Ventures, Cipio Partners, and BlackRock (EU)

Squared Circles, a consumer-focused venture studio, raised a $40M Series A led by L Catterton (PRN)

Doconomy, a Swedish fintech providing banks with tools to drive climate action, raised a $37.2M Series B led by UBS Next and CommerzVentures (EU)

Firefly, an Israeli multi-cloud control plane solutions platform, raised a $23M Series A led by Vertex (FN)

Maxa, a startup helping companies automate financial, ERP, and operational reporting, raised a $21M Series A led by Framework and BDC Capital (FN)

Spanish mental health solution provider ifeel raised a $20M Series B led by FinTLV Ventures and Korelya Capital (FN)

Pharmacy/healthcare operations AI workflow automation platform Plenful raised a $17M Series A led by TQ Ventures (BW)

Remark, a product guidance startup for online stores, raised a $10.3M round from Spero Ventures, Stripe, and more (FN)

Fortunafi, an on-chain financial company, raised $9.5M in funding from Shima Capital, Manifold, Cobie, and others (FN)

Bootloader Studio, an affective AI and spatial computing startup, raised a $5M seed round led by Antler Elevate (FN)

Basalt Technologies, a spacecraft OS company, raised a $3.5M seed round led by Initialized Capital (FN)

HoundDog.ai, a startup implementing data security and privacy controls at the code level, raised a $3.1M seed round from E14 Fund, and others (FN)

Viable, an intelligent fintech platform for consumer brands, raised a $3.1M seed round from Episode 1, Haatch, and Portfolio Ventures (FN)

IPO / Direct Listings / Issuances / Block Trades

Debt

Chinese state-backed developer China Vanke is in advanced talks with major banks for a $6.9B loan (BBG)

Sandwich chain Subway raised $3.35B through an asset-backed securitization, the largest of its kind, after receiving over $19B in orders (BBG)

Australia’s Woodside Energy Group secured a $1B loan from Japan Bank for International Cooperation to develop a natural gas project (BBG)

Thai energy producer B.Grimm Power is seeking up to $600M in private debt to build an offshore wind farm (BBG)

Luxury hotel operator Shangri-La Asia is seeking to raise $138M through a panda bond (BBG)

Car rental company Hertz is exploring options to raise financing (BBG)

Bankruptcy / Restructuring / Distressed

A bankruptcy court cleared WeWork to exit Chapter 11, eliminate $4B in debt, and hand control to a group of lenders and real estate tech firm Yardi Systems (RT)

Takeoff Technologies, a provider of automated systems for grocery chains, filed for Chapter 11 bankruptcy with plans to sell its assets (WSJ)

Maxeon Solar Technologies issued a going concern warning and will receive a $200M investment from its top shareholder TCL Zhonghuan (BBG)

Fundraising

Canadian asset manager Sagard closed its first senior-lending fund at $741M (WSJ)

Crypto Corner

Exec’s Picks

FT published a piece on the uncommon investment attracting the attention of the super-rich: hypercars.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter