Together with

Good Morning,

OpenAI is working on an in-house AI chip, big banks see dealmaking growth continuing into next year, early megacap earnings came in mixed, and Russia fined Google more money than what exists on Earth.

Invest in institutional-caliber private markets with 10 East, a membership-based investment platform offering targeted exposure to PE, VC, and more.

Let's dive in.

Before The Bell

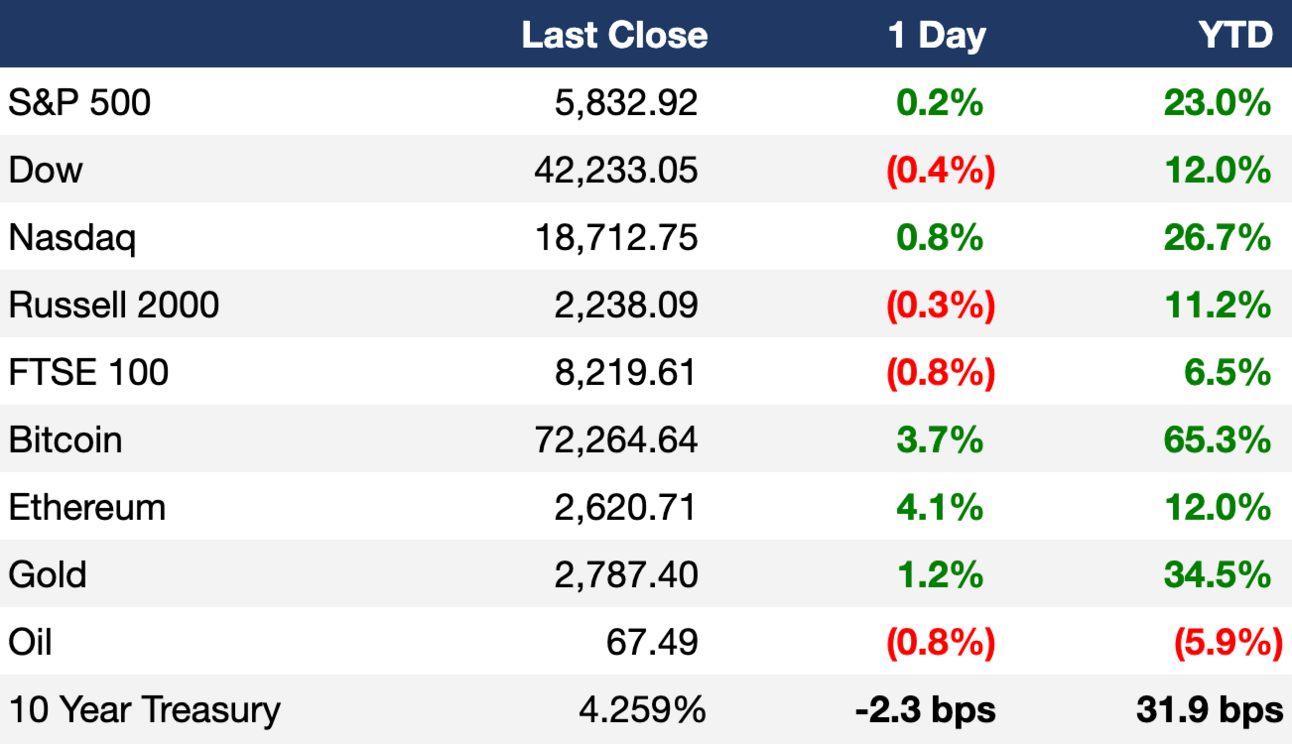

As of 10/29/2024 market close.

Markets

US stocks mostly rose as investors braced for a slew of megacap earnings

Nasdaq closed at a new record high

US bond markets are pricing the biggest post-election volatility in over 30 years, with some targeting a 4.5% yield on the 10Y

UK 10Y gilt yields hit 4.32%, a post-election high

Gold hit a fresh record high

Bitcoin hit $73k for the first time since March, inches away from an ATH

Earnings

Alphabet rose 6% after beating Q3 EPS and revenue estimates as its AI offerings boosted growth in its cloud unit (CNBC)

AMD fell 8% despite doubling revenue for a second-straight quarter as its in-line Q4 forecast failed to impress growth-hungry AI investors (CNBC)

Reddit jumped 25% after beating Q3 estimates and forecasting an optimistic Q4 on resilience in user traffic (CNBC)

Visa beat Q4 EPS and revenue estimates on an 8% jump in payments volume; it will cut 1.4k jobs to streamline its international business (WSJ)

PayPal fell 4% after missing on Q3 revenue and Q4 guidance as the fintech seeks to address deteriorating take rates (CNBC)

Chipotle fell 5% after missing Q3 revenue and same-store sales expectations as growth across income brackets and a re-emphasis on generous portions failed to meet investors' high bar (CNBC)

McDonald's beat Q3 EPS and revenue estimates as US restaurants reversed a same-store sales decline, though the E. coli outbreak may weigh on Q4 (CNBC)

Pfizer beat Q3 EPS and revenue estimates and hiked FY guidance on strength in its Covid products; a crucial win amid an activist campaign (CNBC)

What we're watching this week:

Today: Microsoft, Meta, Coinbase, Eli Lilly

Thursday: Apple, Amazon, Intel, Uber

Friday: ExxonMobil, Chevron

Full calendar here

🇺🇸 Election Forecast

Trump's lead is hovering near a 28% high on Kalshi! Get $20 to trade the election when you deposit $100 or more. See live odds and bet now.

Headline Roundup

US job openings dropped to the lowest since January 2021 (CNBC)

China may issue over $1.4T in extra debt over next few years (RT)

Goldman and Morgan Stanley CEOs see more dealmaking in 2025 (RT)

FTC's new merger rules came from rare bipartisan compromise (BBG)

Asset-backed debt sales topped $313B to beating a post-GFC record (BBG)

JPMorgan says fear has receded in a $1.8T SSLs market (BBG)

PwC profits fell 13% in Asia after China and Australia scandals (FT)

Saudi Arabia's PIF is pivoting away from international investments (FT)

OpenAI is working with Broadcom and TSMC to build in-house AI chips (RT)

Adani Enterprises profit rocketed 7x on growing infrastructure business (FT)

Russia fined Google $2.5D (MT)

Adidas settled all lawsuits with Kanye West (WSJ)

'Roaring Kitty' Keith Gill dissolved his entire stake in Chewy (RT)

Feds raided the NYC jail where SBF and Diddy are being held (BBG)

A Message from 10 East

Where Sophisticated Investors Access Private Markets

10 East is a co-investment platform where sophisticated investors access private market investments alongside a veteran team with a 12+ year track record of strong performance across over 350 transactions. The firm is led by Michael Leffell, former Deputy Executive Managing Member of Davidson Kempner.

Members have the flexibility to participate on a deal-by-deal basis across private equity, credit, real estate, and venture capital.

Benefits of 10 East membership include:

Flexibility – members have full discretion over whether to invest on an offering-by-offering basis.

Alignment – principals commit material personal capital to every offering.

Institutional resources – a dedicated investment team that sources and diligences each offering.

There are no upfront costs or commitments associated with joining 10 East.

Exec Sum readers can join 10 East with complimentary access here.

Deal Flow

M&A / Investments

BlackRock is in advanced talks to buy private credit giant HPS at an over $11B valuation

America's largest pipeline system Colonial Pipeline is weighing a sale at a $10B valuation

Europe's largest broadcaster RTL Group is exploring a merger for its $2.1B Fremantle production unit

A JV between Hilco Global and TPG acquired rights to B. Riley Financial's consumer brands for $236M

Municipal finance lender Preston Hollow is exploring a sale

Sports PE firm Arctos is in talks to buy minority a stake in NFL's Buffalo Bills

Czech utility CEZ acquired a 20% stake in Rolls-Royce's small nuclear reactor business

Abu Dhabi-owned growth equity firm CYVN agreed to acquire 100% of McLaren's automotive business from Bahrain's SWF Mumtalakat

VC

Musk's xAI in talks to raise funding at a $40B valuation

Data center start-up Crusoe Energy is raising $500M at a $3B valuation led by Founders Fund

Fingercheck, a payroll and HR platform for SMBs, raised a $115M growth round led by Edison Partners

African fintech Moniepoint raised a $110M Series C at a $1B valuation led by Development Partners International

GMI Cloud, a GPU cloud infrastructure startup, raised an $82M Series A led by Headline Asia

INBRAIN Neuroelectronics, a brain-computer interface therapeutics startup, raised a $50M Series B led by imec.xpand

Petfolk, a provider of veterinary and urgent care, raised a $36M Series C led by Deerfield Management

Reflexivity, an AI solutions for the investment industry, raised a $30M Series B led by Greycroft and Interactive Brokers

EvoluteIQ, an AI-powered end-to-end automation platform, raised $20M led by Round2 Capital

Elevate, a consumer-directed benefits administration platform, raised a $20M growth round led by Fin Capital

Infraspeak, a collaboration platform for facility management, raised a $19.5M Series B led by Endeit Capital

Semble, a UK-based healthtech SaaS startup, raised a $15M Series B led by Mercia Ventures

Brightwave, an AI agent to help asset managers find signal, raised a $15M Series A led by Decibel Partners

Tilled, a PayFac-as-a-Service startup, raised $12.5M in funding led by Canvas Ventures and UPC Capital Ventures

HOMEE, an AI-driven direct repair network for the insurance industry, raised a $12M Series C led by W.R. Berkley Corporation

RIFT, a startup decarbonizing energy-intensive industries with iron fuel, raised an $11.5M Series A from PGGM, Invest-NL, and more

Table22, an e-commerce tools for the food and beverage industry, raised an $11M Series A led by Lightspeed Venture Partners

Matia, a unified data operations platform, raised $10.5M led by Leaders Fund and Secret Chord Ventures

Infinite Machine, a startup building futuristic urban transit alternatives, raised a $9M seed round led by a16z

CredibleMind, a mental wellbeing platform, raised a $7.5M Series A led by Horizon Mutual

Auquan, an AI startup automating deep work in finance, raised a $4.5M seed extension led by Peak XV

IPO / Direct Listings / Issuances / Block Trades

Boeing raised $21.1B in an expanded share sale

Debt

Colombia sold $3.6B of dollar bonds

Slovakia sold $2.2B of Eurobonds in a syndicated sale

Soccer team investor Eagle Football is seeking to borrow $300M to help repay part of a loan from Ares

Bankruptcy / Restructuring / Distressed

TPG-owned orthopedics medtech Exactech filed for bankruptcy after being sued for defective implants

Fundraising

Blackstone raised $22B for an evergreen direct-lending fund

Energy-focused PE firm Quantum Capital raised $10B for its eight flagship and other funds

TPG raised $4.4B for its second climate fund

Adams Street Partners raised $1.1B for its Global Fund Program to invest in small to mid-market firms

Carlyle-subsidiary AlpInvest Partners closed a $1B collateralized fund obligation

Hollywood's Olivia Wilde co-founded Proximity Ventures with plans to raise over $100M

Crypto Corner

Exec’s Picks

Alt Managers, stop wasting your time managing vendors, contracts, invoices, and expense allocations manually in Excel. StavPay was built to automate and streamline this process and now has over 90 managers with $2.2T AUM leveraging the system daily. Learn more at stavpay.com and schedule a demo today.

Recruiting for Investment Banking? Check out Leland's Investment Banking Recruiting Bootcamp taught by expert coaches from top banks. Includes 8 hours of LIVE instruction, technical skill assignments and drills, 1:1 mock interview with expert coaches and more. Use code "LIT600" to get 50% off!

Joachim Klement explained the curious case of why stock market momentum seems to persist across borders.

Callie Cox wrote an interesting piece on the issue of US national debt, this time playing the devil's advocate.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity’s brain on business advice, insights, or just chat to say what’s up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.