Together with

Good Morning,

A Citadel prospectus offered a rare glimpse into the hedge fund's returns, 3% of federal workers accepted the DOGE buyout, bond traders are skeptical of Bessent's 10Y yield pledge, and KKR sees 2025 as credit's 'iPhone moment.'

A team of Zillow execs founded Pacaso to democratize co-ownership of premier properties and while they've already raised capital from top VCs, they're inviting retail investors to help them expand. Check out the opportunity.

Let's dive in.

Before The Bell

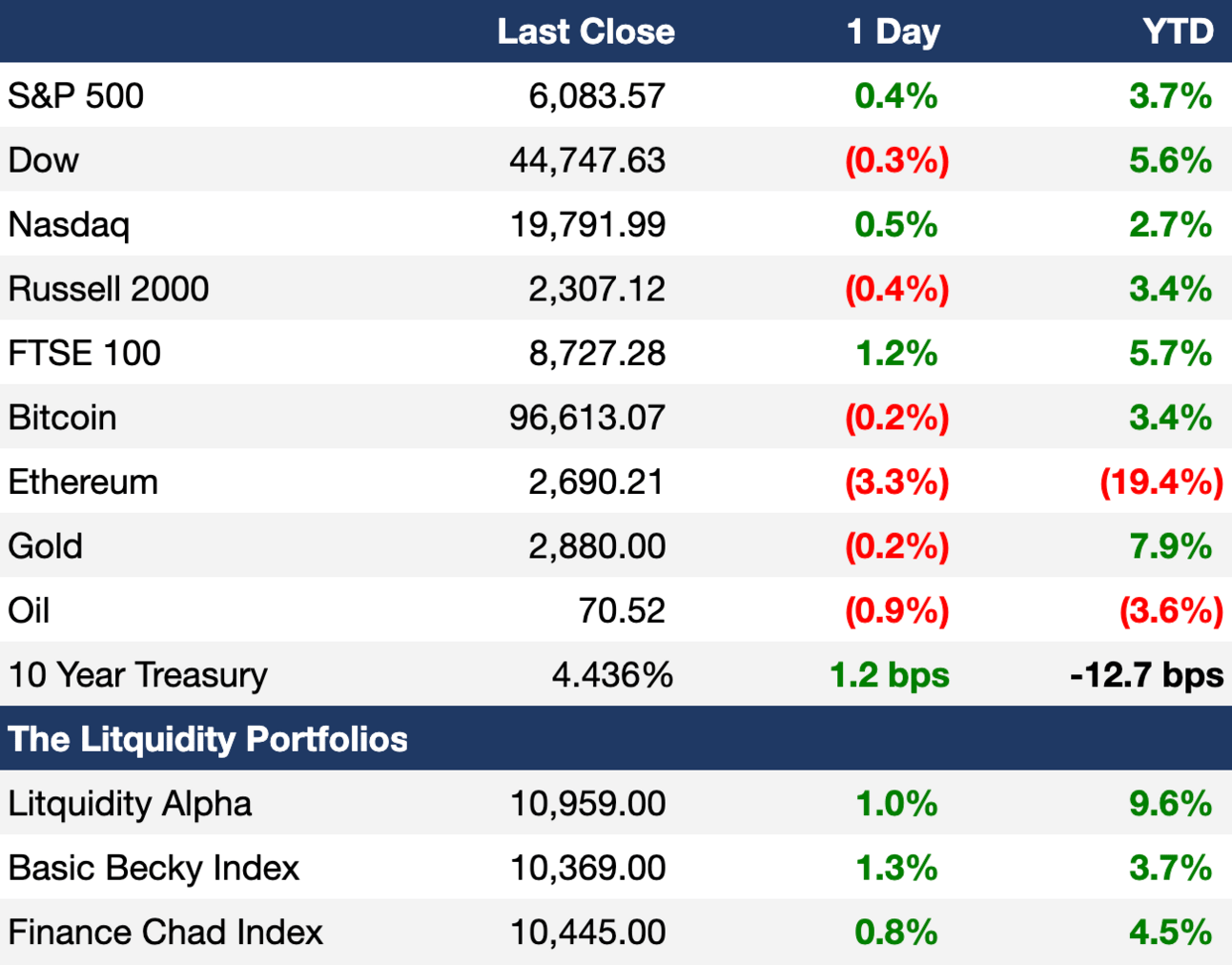

As of 2/6/2025 market close.

US stocks closed mixed yesterday as investors digested earnings and trade sentiment

Europe's Stoxx 600 hit a new ATH on strong earnings and Ukraine-war optimism

UK's FTSE 100 hit a new ATH on a BoE rate cut

UK 10Y gilt traded at 4.5%, down from multi-decade highs of 4.9% in January

Dollar is up 7% since September lows, trading near a two-year high

Pound fell 0.5% from a one-month high

Japanese Yen hit an eight-week high on hawkish BOJ commentary

China kept the yuan steady in its first fix since US tariffs

The Litquidity Pilot Portfolios are live on Autopilot! Click here to learn more and subscribe to the Litquidity strategies.*

Earnings

Amazon beat Q4 earnings estimates but forecast its weakest Q1 revenue growth ever on FX headwinds and sky-high AI demands despite projecting $100B in FY CapEx (CNBC)

Eli Lilly beat Q4 earnings estimates but reported weaker-than-expected sales for its blockbuster weight loss and diabetes drugs (CNBC)

Peloton reported mixed Q4 results but surged 12% after blowing past adjusted EBITDA estimates as it sacrifices sales growth in a push to profitability (CNBC)

Full calendar here

Headline Roundup

Citadel offered rare glimpse into flagship multi-strategy funds (BBG)

3% of federal workforce accepted DOGE 'buyout' (CNBC)

US productivity rose at the fastest pace in 14 years last year (BBG)

BoE cut rates by 25 bps to 4.5% (CNBC)

ECB warned Europe could be big loser in US-China trade war (RT)

Fed ended climate stress-test burden for banks (BBG)

KKR called 2025 credit's 'iPhone moment' amid public-private meld (BBG)

Blue Owl won't follow peers building private credit marketplaces (BBG)

Brookfield plans private credit sales push and ramped up hiring (BBG)

Bond markets are skeptical of Bessent's 10Y yield pledge (RT)

Surging dollar spurs jump in corporate FX hedging (RT)

Traders see profits evaporate in minutes as Trump convulses bets (BBG)

Firms wary of new rules scramble to file M&As by this week (RT)

Saudi IPO spree deepens diversification in stock market (BBG)

Regional banks raise billions in equity for M&A and balance sheet boost (RT)

A judge partly paused DOGE access to Treasury data (BBG)

Wall Street firms face scrutiny from Republican AGs over China risk (RT)

Amazon is set to pass Walmart as the largest company by revenue (CNBC)

Australian firms facing investor anger over exec pay is at record high (RT)

McKinsey partners debate China presence as US tensions rise (BBG)

Citigroup promoted another 8.5k employees this year (RT)

HSBC is in talks to pay new CEO Georges Elhedery $19M (FT)

Generali's biggest investor wants to oust its long-standing CEO (RT)

Zuckerberg visited the White House for meetings (WSJ)

OpenAI co-founder John Schulman left Anthropic after just five months (TC)

OpenAI will run a Super Bowl ad (WSJ)

Equinor scaled back renewables push years after ditching 'oil' from name (FT)

A Message from Pacaso

Top investors are buying this unlisted stock

When the team that created Zillow and grew it into a $16B real estate leader starts a new company, investors take note. That’s why top firms like SoftBank and Maveron already invested in Pacaso.

Taking the industry by storm all over again, Pacaso's streamlined platform offers co-ownership of premier properties – completely revamping a $1.3T market.

This approach maximizes demand by minimizing costs and worries. And by handing keys to 1,500+ happy homeowners, Pacaso has made $100M+ in gross profits.

Now, they're focused on international expansion – with record-breaking sales in Paris and new properties in Cabo and London.

You can join them as an investor – but with this expansion underway, the current share price won't last long. Invest at $2.70/share by February 27.

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com.

Deal Flow

M&A / Investments

Italy's fourth-largest bank BPER offered to acquire domestic peer Banca Popolare di Sondrio in a $4.5B all-share deal

Canada's OTPP is exploring a sale of legal and compliance software firm Mitratech at a $4.6B valuation, including debt

Czech billionaire Daniel Kretinsky is seeking to take German wholesaler Metro private at a $2.1B valuation

PE firm TPG will acquire solar firm Altus Power for $2.2B , including debt

PE firm Permira agreed to acquire fire safety firm Encore Fire Protection for $1.8B, including debt

Paysafe, a $1.4B-listed UK online payments firm backed by Blackstone and CVC, is exploring a sale after attracting takeover interest

Canada's BCI agreed to acquire investment firm BBGI Global Infrastructure for $1.3B

Warner Music Group acquired a controlling stake in Tempo Music, which owns song rights to Bruno Mars, Adele and Wiz Khalifa, at a $450M valuation

UK asset manager M&G acquired a 70% in $4B AUM Swedish private credit firm P Capital Partners

BP joined peers in plans to sell German refining and chemicals assets due to high costs

VC

X-energy, a startup developing advanced nuclear reactor and fuel technology, raised a $700M Series C-1 led by Amazon, Citadel's Ken Griffin, and Ares

XOi, a software for field service engineers, raised a $230M round from KKR

Wealthon, a Polish fintech startup, raised $7.3M from 3TS Capital Partners

Stratospheric platform company Urban Sky raised a $30M Series B led by Altos Ventures

TrueFoundry, a startup helping enterprises deploy AI systems at scale, raised a $19M round led by Intel Capital

Presto, a 'Stripe for EV charging,' raised a $15M seed round led by Union Square Ventures

Cognida.ai, a practical AI solutions startup for enterprises, raised a $15M Series A led by Nexus Venture Partners

fileAI, a Singaporean horizontal file processing agent and AI workflow automation startup, raised a $14M Series A led by Illuminate Financial, Antler Elevate, and more

Tyba, an energy storage optimization startup, raised a $13.9M Series A led by Energize Capital

Cellid, a Japanese developer of AR glasses displays and spatial recognition engines, raised a $13M round led by Development Bank of Japan

Comstruct, a startup digitizing the construction industry, raised a $13M Series A led by GV and 20VC

REEV, a medtech startup developing intelligent, lightweight wearable robotics, raised a $9.2M round led by Newfund Heka, Polytechnique Ventures, and Irdi Capital

MacroCycle Technologies, a startup recycling plastic waste into virgin-grade plastic, raised a $6.5M seed round led by Clean Energy Ventures and Volta Circle

Podero, a startup helping utilities reduce energy costs, raised a $5.7M seed round led by Planet A Ventures

Astral Systems, a compact nuclear reactor startup, raised a $5.6M round led by Speedinvest and Playfair

Drip Water, a UK lifestyle water brand, raise a $5M round at a $125M valuation from Raya Holding

Trace.Space, an AI-driven product engineering platform, raised a $4M seed round led by Cherry Ventures

INXY Payments, a European payments platform bridging TradFi and DeFi, raised a $3M round led by Flashpoint VC

IPO / Direct Listings / Issuances / Block Trades

Carlyle-owned IT consulting and services firm Hexaware Technologies is seeks to raise $1B in a trimmed India IPO

Luxury logistics firm Ferrari Group is seeking to raise $212M at an $848M valuation in an Amsterdam IPO

Honeywell International will separate its aerospace and automation units and spinoff its advanced-materials arm amid pressure from activist Elliott

Crypto exchange Gemini is considering an IPO as soon as this year

Debt

The founding family-led consortium proposing a record $58B MBO of 7-Eleven-owner Seven & i tapped Citigroup and Bank of America for financing

Saudi Arabia's PIF is in talks with Italian insurer and export credit agency SACE for $3.1B in loan guarantees

Blue Owl Capital agreed to buy $2.4B of consumer loans from fintech Pagaya Technologies

Canadian telecom Rogers Communications is preparing to sell US and Canadian dollar-denominated junk bonds to help fund its $3.3B purchase of a 37.5% stake in Maple Leaf Sports & Entertainment

Bankruptcy / Restructuring / Distressed

Distressed-debt investors including Strategic Value Partners, Fortress Investment Group, MBK Partners, Deutsche Bank and Mizuho Bank are in talks with KKR-owned car parts supplier Marelli over $4.2B of debt that could push the firm into restructuring for the second time in three years

Atlantic Street Capital-backed car wash operator Zips Car Wash filed for Chapter 11 bankruptcy with plans to hand over control to private credit lenders including HPS, PennantPark Investment, and Brightwood Capital Advisors

EV truck-maker Nikola is nearing a bankruptcy filing

Volvo will acquire bankrupt Northvolt's 50% stake in their Novo Energy battery JV for $0

Fundraising

Private credit impact investor o15 Capital Partners closed its debut fund at $400M

Crypto Sum Snapshot

FDIC is rethinking crypto guidance as senate probes debanking

SEC ousted a top litigator who battled with crypto giants

90% of Brazil's crypto surge is linked to Stablecoins

Check out our Crypto Sum newsletter for the full stories on everything crypto!

Exec’s Picks

Conor Mac explains why doing less is often an important and constant battle for investors.

Ben Carlson wrote another great piece on the superpower of knowing how to not freak out.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

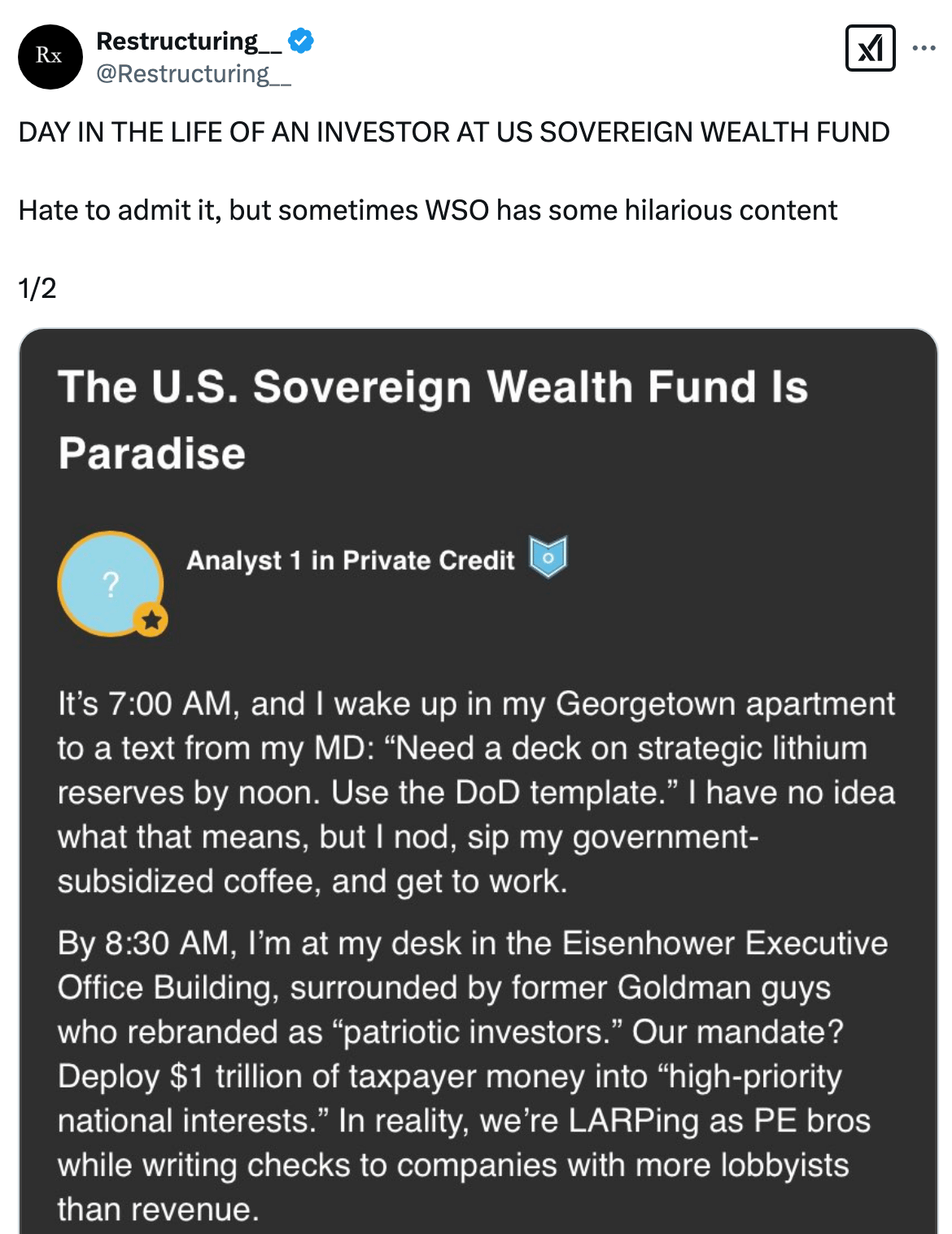

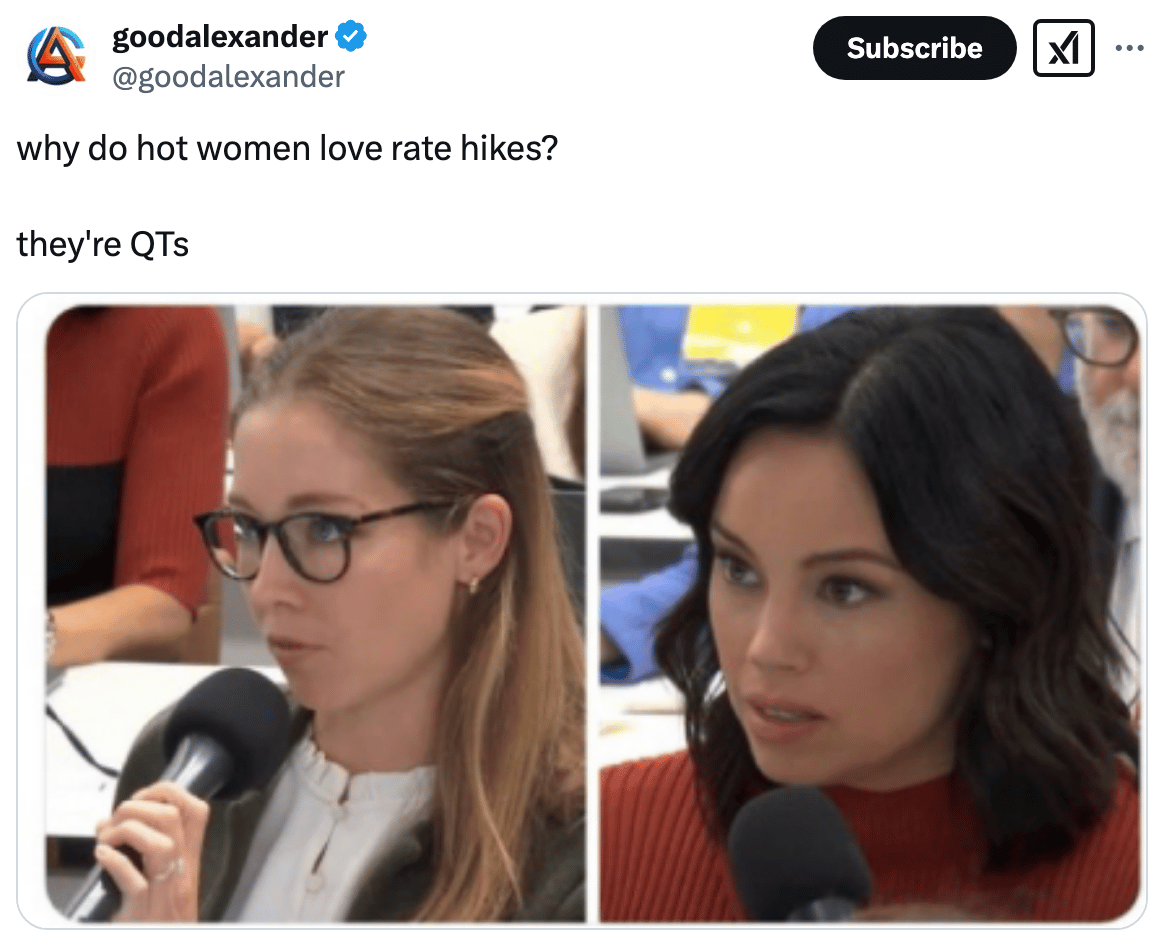

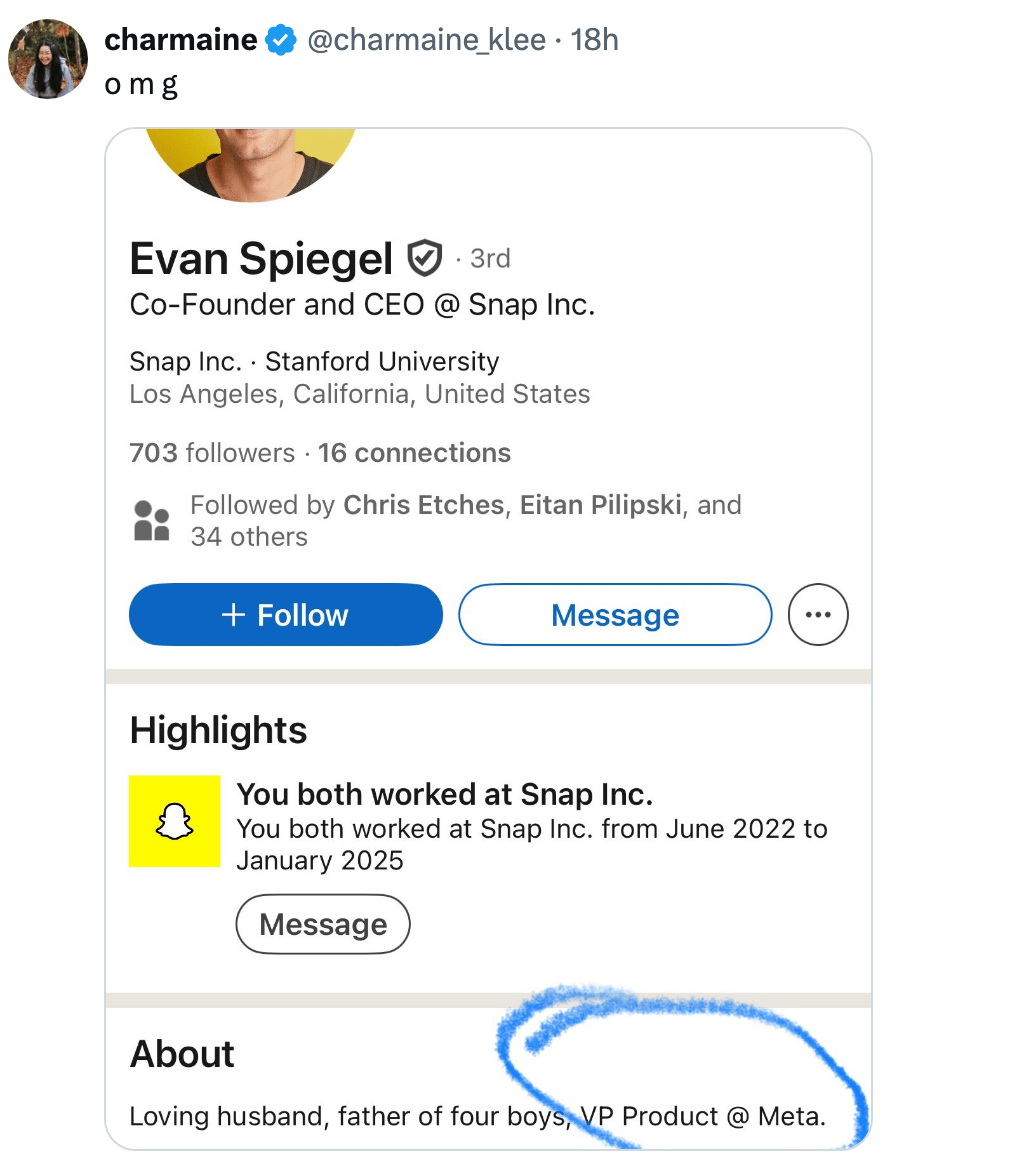

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.

*DISCLAIMER: Investment advice provided by Autopilot Advisers, LLC ("Autopilot"), an SEC-registered investment adviser. Past performance does not guarantee future results. Investing carries risks, including loss of principal. As always be smart out there.