Together with

Good Morning,

Average Manhattan rent broke $5,000, an inverse Tesla ETF is hitting the market, the SEC is investigating Musk's past tweets, the Euro slipped below the Dollar, Stripe cut its internal valuation by 28%, bank earnings are down, and OpenSea is the latest tech company to cut jobs.

Shoutout to today's sponsor, More Labs, for supporting the newsletter. Been drinking their products for a few years and am a big fan.

Let's dive in.

Before The Bell

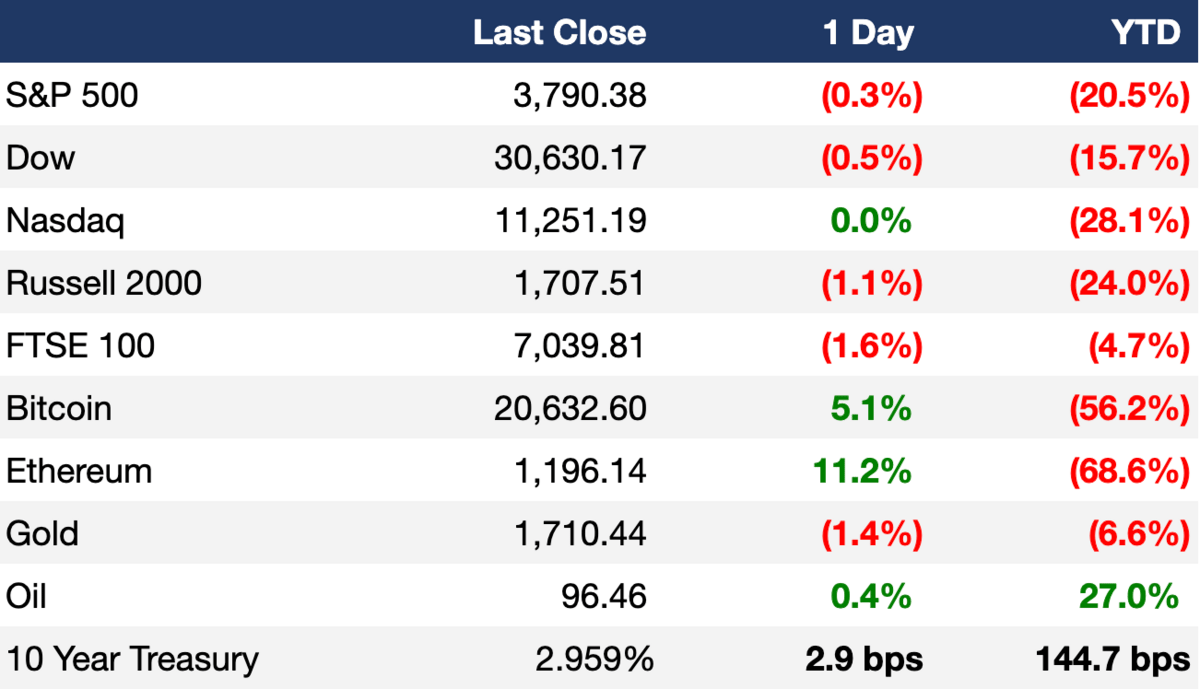

As of 7/14/2022 market close.

Markets

Stocks fell sharply to begin the day before gradually climbing back, but the broader market still finished in the red

The S&P 500 fell for its fifth consecutive day with the energy sector being the biggest loser, dropping 2.4%

Oil briefly dipped below $95 a barrel for the first time since Russia invaded Ukraine, as investors fear an impending global recession that will negatively impact demand

Earnings reports from top financial institutions highlighted concerns about the future economic outlook; more reports are coming today

Earnings

JPMorgan Chase fell 3.5% after reporting a 28% year over year earnings decline; they also set aside $428M to cover potential future loan losses amidst an uncertain economy (CNBC)

Morgan Stanley also missed earnings expectations with Q2 profits down 29% from 2021 thanks to a drop in corporate deal making; their stock fell 0.4% on the day (WSJ)

TSMC rose 2.9% after exceeding expectations and recording a record net profit for Q2 of $8.06B (CNBC)

What we’re watching today: UnitedHealth Group, WellsFargo, Citibank, Progressive, BlackRock, PNC Financial Services

Full calendar here

Headline Roundup

The Labor Department’s producer-price index increased to 11.3% in June (WSJ)

30-year fixed mortgage rates rose for the first time in three weeks to 5.51%, just one week after the biggest weekly decline since December 2008 (WSJ)

Jobless claims rose to 244K last week, their highest level this year, but remain near historic lows (WSJ)

Average Manhattan rent surged to a record $5,000 in June for the first time ever (AX)

Euro slips below Dollar as Europe's economic fortunes slump (WSJ)

Credit Suisse's chairman sees the banks future as an independent entity, despite on-going scandals and takeover speculation (FT)

Property surveyors expect UK house prices to keep increasing over the next year despite a drop in new buyers (BBG)

Inverse Tesla ETF is among the first single-stock ETFs to hit the US (BBG)

Saudi Arabia doubled its Q2 Russian fuel oil imports to meet summer power generation demands (RT)

Fed Chair Jerome Powell and former Vice Chair Richard Clarida were cleared of wrongdoing in a securities trading controversy (CNBC)

Italian Prime Minister Mario Draghi submitted his resignation after a key party in his coalition pulled its support for his government; Italy’s president won’t accept Draghi’s resignation (WSJ)

The SEC is scrutinizing Musk's past tweets as he seeks to abandon his $44B Twitter deal (RT)

Payments giant Stripe cut its internal valuation of its shares by 28% (WSJ)

Bank of America has been fined $225M for mishandling the distribution of unemployment benefits during the height of the pandemic (WSJ)

A Message From More Labs

Level up with More Labs

You want to do it all, and make no compromises? Meet More Labs, a consumer goods startup that creates science-backed products to solve real, everyday problems.

Founded by a techie who worked for Elon Musk at Tesla, Zuckerberg at Facebook and helped launch Uber in the South Asian market. More Labs first crashed onto the scene with a viral kickstarter campaign for their product Morning Recovery, a ready to drink shot designed to help you bounce back after drinking alcohol and help you skip the dreaded “rough morning”.

You may have seen their memes on our Litquidity IG stories over the years.

They now make targeted solutions for everything from drinking to focus and sleep. Check out their Liquid Focus to help you get sh*t done, and their Dream Well for when you need to snooze. Even better, they just launched a new version of Morning Recovery that has a boost of natural caffeine for when you really want to party.

All of their products are designed to optimize your system, so you can maximize every moment and get more out of life. Plus they are vegan, gluten free and have a clinical trial to back their science.

Perfect for those of us who approach life with a ‘work hard, play hard’ mentality. Time to level up. Try it here.

Deal Flow

M&A / Investments

A consortium of Canada's Brookfield Asset Management and infrastructure investment firm DigitalBridge acquired a 51% stake in telecommunications company Deutsche Telekom’s GD Towers' unit, that valued the business at $17.5B (BBG)

SK Capital Partners is considering a sale of polymer producer Geon Performance Solutions that could value the company at ~$2B (BBG)

Apax Partners is weighing a sale of aesthetic device maker Candela Medical in a deal that could value the company at over $1B (BBG)

PE firm Actis hired Citigroup to help with the sale of BTE Renewables, a South African green energy supplier, at a potential $1B valuation (BBG)

Activist investment fund Elliott Management reported holding over a 9% stake in social media platform Pinterest, causing the company's shares to jump over 20% in extended trading (CNBC)

Resort and Casino operator MGM Resorts International expressed takeover interest in Singapore rival Genting Singapore (BBG)

Natural gas producer ConocoPhillips agreed to acquire a 30% stake in energy infrastructure company Sempra Energy's proposed LNG plant in Port Arthur, TX (RT)

VC

Monolith, a sustainable energy and chemicals company, raised a $300M funding round co-led by TPG Rise Climate and Decarbonization Partners (PRN)

Bishop Fox, an offensive cybersecurity company, raised a $75M Series B led by Carrick Capital Partners (GNW)

Manifold Bio, a next-generation protein therapeutics company, raised a $40M Series A led by Triatomic Capital (BW)

AssemblyAI, an AI-as-a-Service vendor, raised a $30M Series B led by Insight Partners (TC)

Hivery, an optimization platform for retailers, raised a $30M Series B led by Tiger Global (TC)

Robin, a hybrid workplace platform, raised a $30M Series C led by Tola Capital (TC)

Detect Technologies, an AI-based SaaS enterprise, raised a $28M Series B led by Prosus Ventures (PRN)

Okendo, a customer marketing platform, raised a $26M Series A led by Base10 Partners (TC)

You, an AI-powered platform that sorts through and manages search engine data, raised a $25M Series A led by Radical Ventures (TC)

Trading platform Lightyear, a European challenger to Robinhood, raised a $25M Series A led by Lightspeed Venture Partners (CNBC)

Web3 gaming company UnCaged Studios raised a $24M Series A from Griffin Gaming Partners, Vgames, and others (CD)

Canvas Medical, an electronic medical records startup, raised a $24M Series B led by M13 (TC)

Travel platform KKDay raised a $20M extension to its Series C led by TGVest Capital, bringing its total to $95M (TC)

Hang, an NFT-powered membership and loyalty rewards platform, raised a $16M Series A led by Paradigm (TB)

Nucleus Genomics, a next-generation consumer genetic testing and analysis company, raised a $14M seed round led by Seven Seven Six (PRN)

Stationhead, a social music platform for connecting artists and fans around the world, raised a $12M Series A led by Buttonwood Group Advisors (PRN)

Onramp Invest, a digital asset platform for financial professionals, raised a $7M Series A led by JAM FINTOP and the EJF Silvergate Ventures Fund (BW)

Virtual avatar company Hologram raised a $6.5M seed round led by Polychain Capital (CD)

Supermojo, a financing platform for NFTs, raised a $6M seed round led by BH Digital, DRW Venture Capital, Intersection Growth Partners, and Neuberger Berman (TB)

Bobidi, an AI model test platform, raised a $5.8M seed round from Y Combinator, We Ventures, and others (PRN)

Kindly, a hormonal healthcare provider, raised a $3.25M seed round from Y Combinator, Olive Tree, and others (TC)

IPO / Direct Listings / Issuances / Block Trades

Chinese fast-fashion giant Shein is planning a US IPO as soon as 2024, the company is currently valued at ~$100B (CNBC)

SPAC

Digital mortgage lender Better filed paperwork on Thursday to go public via a SPAC merger with Aurora Acquisition Corp (YHOO)

Debt

PE firm Clayton Dubilier & Rice will buy $464M of PIK Notes for its own buyout of commercial construction company Cornerstone Building Brands to limit the potential losses to Deutsche Bank and UBS (BBG)

Bankruptcy / Restructuring

Pharmaceutical company Endo International is considering filing for bankruptcy as a means to restructure its $8B+ of debt and thousands of outstanding opioid crisis-related lawsuits (WSJ)

Fundraising

Collaborative Fund raised $200M for its new Collab SOS fund, the company intends to invest in Series A and Series B companies fueling a more sustainable economy across materials, ingredients, energy and supply chains (CF)

Iter Investments, a venture capital firm focused on the psychedelic industry, raised over $20M for its Fund I (PRN)

Crypto Corner

JPMorgan analysts estimate that bitcoin’s production costs have dropped to $13K, which could indicate a further price drop (TB)

VC funding in the blockchain sector fell 22% in Q2, ending seven consecutive quarters of growth (TB)

Physical futures crypto exchange CoinFLEX is now allowing customers to withdraw 10% of their account balances, excluding its flexUSD stablecoin (CD)

NFT marketplace OpenSea cut ~20% of its staff in another layoff decision in the crypto industry (BBG)

Circle, the fintech company best known for its dollar-pegged stablecoin, USDC, disclosed ~$56B worth of cash, treasury reserves (TB)

Exec's Picks

Never missing a beat, South Park dropped a new episode picking fun at the celebrity crypto ads from the last year. Check it out here.

Are you a current or former investment banker / PE investor looking for reliable a financial data service that won't cost an arm and a leg like a Bloomberg Terminal, CapIQ, or FactSet? Koyfin is a platform I recently started using to perform fundamental analysis and track my personal portfolio. They've got several affordable plans for current and former professionals and a sleek, modern interface that's easy to navigate. Check them out here.

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.