Together with

Good Morning,

Foreign investments are flowing back into China, Goldman and JPMorgan are competing for the top deal advisory spot, short sellers made $848M in paper profits on bets against First Republic in March, Apple announced a first round of job cuts, Finland joined NATO, and the US brought criminal charges against Frank's founder.

If you work in venture capital, private equity, or M&A, check out this industry breakdown created by today's sponsor, Axios Pro.

Let's dive in.

Before The Bell

Markets

All three major US indexes fell yesterday on fears of a fast cooling economy

10Y yield hit its lowest level since September on US job openings data

2Y yield plunged nearly 74 bps in the worst monthly decline since January 2008

Dollar hit a ten-month and two-month low versus the pound and euro respectively

Traders are pricing in a 60% chance of no Fed rate hike in May

Earnings

What we're watching this week:

Thursday: Constellation Brands, Levi Strauss

Full calendar here

Headline Roundup

US job openings fell below 10M for first time since 2021 (BBG)

Reserve Bank of Australia held rates at 3.6% (WSJ)

Lending conditions and term loans have tightened 'sharply' (AX)

Foreign investments are flowing back to China after Alibaba plans (RT)

China slowed their merger reviews of proposed acquisitions by US firms (RT)

Goldman and JPMorgan are competing for No. 1 deal advisory spot (RT)

Short sellers made $848M in paper profits on bets against First Republic in March (RT)

Signature Bank insiders sold $100M in stock during crypto surge (WSJ)

AWS debuted a 10-week accelerator for generative AI startups (AX)

Credit Suisse Chairman ‘truly sorry’ for failure to stem crisis (BBG)

Apple will cut corporate retail jobs in first known layoffs (BBG)

16% of US college kids want to work for Google (AX)

GM buyouts cut 5k salaried jobs (RT)

Walmart will cut over 2k jobs in e-commerce warehouses (RT)

Big law Kirkland & Ellis cut associates in California/Texas offices (FT)

Google workers striked in London over job cuts (RT)

Finland became 31st member of NATO (AX)

DOJ and SEC filed criminal charges against Frank's founder (AX)

Trump pled not guilty to 34 counts of falsifying business records (AX)

Big chains are looking to capitalize on pickleball craze (AX)

A Message From Axios Pro

If your work touches venture capital, private equity or M&A, this might be the most important report you read all year.

Why it matters: Knowing what the current economic cooldown means for your bottom line and how to plan for a possible recession is going to be your edge. Thanks to the Axios Pro newsroom, their latest industry report will tell you everything you need to know.

Their industry-leading journalists put this downturn into context and uncover how market forces are affecting dealmaking in fintech, health tech, climate tech, retail and media.

The bottom line: The Axios Pro newsroom delivers aggregated data and analysis from the biggest players in VC, PE and M&A, plus key industry trends and takeaways to inform every critical decision you’ll make this year.

Deal Flow

M&A / Investments

Iraq agreed to hold a 30% stake in energy company TotalEnergies’ $27B Iraq project, a deal that could lure foreign investment back into the country (RT)

Mexico’s government agreed to buy 13 power generation plants from Spanish renewable energy company Iberdrola in a $6B deal (RT)

French skincare firm L’Oreal agreed to buy luxury cosmetics brand Aesop at a $2.53B valuation (BBG)

Apollo raised its offer to buy British oilfield services and engineering firm John Wood Group to $2.1B (RT)

Investment management firm Rathbones agreed to buy the UK wealth management business of Investec in a $1.05B deal (BBG)

PE firm TPG agreed to buy a majority stake in Elite, a vendor of business management software for law firms, at a $500M valuation from information provider Thomson Reuters (RT)

Kenyan bank KCB Group is in talks to buy stakes in lenders in Ethiopia as it revives plan to expand in the nation (BBG)

VC

Mercy BioAnalytics, a startup developing extracellular vesicle-based liquid biopsies for cancer detection, raised a $41M Series A led by Novalis LifeSciences (FN)

SJSemi, a 12-inch MEOL foundry, raised a $340M Series C+ with participation from Legend Capital, Goldstone Investment, and others (PRN)

Quantexa, an AI-based fraud detection platform, raised a $129M Series E at a $1.8B valuation led by GIC (TC)

Web3 messaging protocol LayerZero raised a $120M Series B at a $3B valuation from investors including a16z crypto, Circle Ventures, Sequoia Capital, OpenSea, Samsung Next, Christie’s and BOND (TC)

Payments infrastructure company TerraPay raised a $100M Series B led by IFC (FN)

Covariant, a startup building an AI logistics automation robot, raised a $75M Series C extension led by Radical Ventures and Index Ventures (TC)

Everstream, a startup using AI to improve supply chain sustainability, raised a $50M Series B led by 1GT, StepStone Group, and Columbia Capital (BW)

Adcendo, a biotech company focused on the development of antibody-drug conjugates (ADCs) for the treatment of cancers with a high unmet medical need, raised a $31M Series A extension led by Pontifax Venture Capital (PRN)

Oncology therapeutics startup Mosaic Therapeutics raised a $28M Series A from backers including Syncona Investment Management and Cambridge Innovation Capital (FN)

Industrial supplier of bio-fabricated silk protein materials AMSilk raised a $27.3M Series C extension led by ATHOS (FN)

Perplexity AI, an AI-powered search platform, raised a $26M Series A led by New Enterprise Associates (TC)

Strivacity, a startup helping companies build secure login flows, raised a $20M Series A-2 led by SignalFire (TC)

HeatTransformers, a Dutch heat pump installation startup, raised a $16.4M Series A led by Energy Impact Partners (FN)

Open-banking enabled fintech Finanzguru raised $14.3M in funding led by SCOR Ventures and PayPal Ventures (PRN)

tado, a Munich, Germany-based intelligent home climate management company, raised a $13.1M round led by S2G Ventures (FN)

AI-powered airfare price prediction startup Fetcherr raised a $12.5M round led by Left Lane Capital (TC)

Alchemy Pay, a Singapore-based payment gateway that connects crypto and global fiat currencies for businesses, developers, and users, raised $10M in funding at a $400M valuation from DWF Labs (FN)

AVS, a medical device startup focused on treating calcified arterial disease, raised an $8.8M Series B extension led by BioStar Capital (BW)

Cloud access management startup Trustle raised a $6M seed round led by Glasswing Ventures (BW)

Nigerian shared mobility startup Shuttlers raised a $4M round led by Verod-Kepple Africa Ventures (TC)

Medherant, a startup developing a testosterone replacement patch for women with menopausal symptoms, raised a $3.75M round led by Mercia Asset Management (FN)

Sepura Home, a startup making your kitchen sink a composter, raised a $3.7M seed round led by sink-maker Blanco (TC)

Ecosapiens, an eco-conscious collective that defends the climate through creative tech, raised a $3.5M seed round led by Collab+Currency (FN)

Zyod, a Delhi, India-based provider of a B2B platform for apparel sourcing and manufacturing, raised a $3.5M seed round led by Lightspeed (FN)

Bioliberty, a UK-based tech startup advancing a soft robotic glove which can restore upper limb mobility in patients following a stroke, raised a $2.75M seed round led by Archangels (FN)

Adludio, an AI-driven platform delivering attention-led and data-driven mobile advertising, raised a $2.5M round from Mercia (BW)

RealSage, a data intelligence and AI startup for the multifamily real estate industry, raised $1.6M in funding led by Golden Section and Plug and Play Ventures (FN)

Megaton Finance, an automated market maker and decentralized exchange, raised a $1.5M seed round led by TONcoin.Fund (FN)

IPO / Direct Listings / Issuances / Block Trades

Chinese lender Yibin City Commercial Bank is considering a Hong Kong IPO that could raise between $200-$300M (BBG)

SPAC

Canadian oil/gas producer Avila Energy will merge with Insight Acquisition in a $193M deal (MW)

Debt

Bankruptcy / Restructuring

Richard Branson’s satellite launching business Virgin Orbit filed for Chapter 11 bankruptcy after struggling to secure long-term funding (RT)

Fundraising

KKR raised $8B for its largest-ever European buyout fund (BBG)

PE firm MidOcean Partners raised over $1.5B for its sixth PE fund (FNN)

Industry Ventures is targeting $1B for its latest flagship VC secondaries fund (SI)

Smash Capital is seeking to raise $500M more for a target $1B VC fund (TI)

Cure Ventures raised an inaugural $350M to invest in seed rounds in biotech startups (FBT)

Tomasz Tunguz raised $230M for his new solo firm Theory Ventures (TI)

Dutch investment firm Polestar Capital raised $205M for its circular economy debt fund (EUS)

Robeco raised $142M for a second closed-ended private debt fund targeting sustainable European businesses (FU)

London-based early-stage VC Anamcara raised $10.6M to invest in B2B firms (FN)

Crypto Corner

OPNX, a crypto-focused exchange that lets users trade claims of bankrupt crypto companies, is now live (CD)

Crypto funds’ bitcoin holdings rise as investor demand rebounds (CD)

Crypto exchange Binance expanded in Argentina (RT)

Race for bitcoin derivatives hit a record high (RT)

Crypto could eliminate 97% of traditional remittance fees: Coinbase (CT)

Exec's Picks

Want to level up your career with a new language? With competition rising across all sectors including finance, multilingual workers have a leg up. Babbel has created a platform to make the learning process easy. The lessons take 10 minutes. Within 3 weeks, you will be able to start having basic conversations in your new language. Yes, 21 days. Get up to 60% off here

Intelligencer covered the wild downfall of Daylight, the "bank" marketed to LGBTQ+ clients.

Jamie Dimon published his 2022 annual letter to JPM shareholders.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

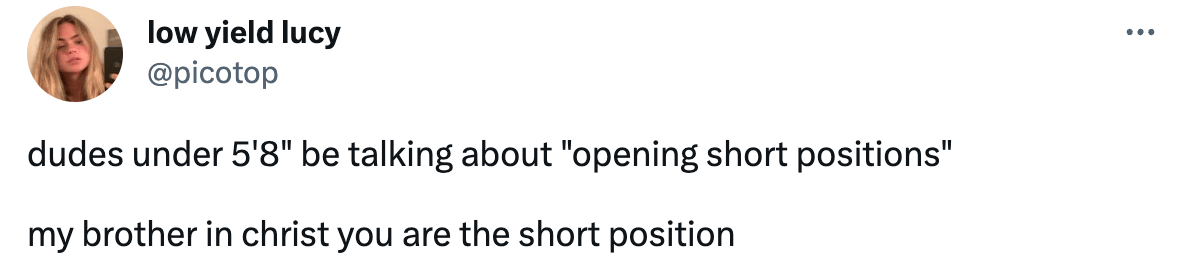

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.