Together with

Good Morning,

FTX moved $10B to Alameda through a backdoor and up to $2B of that is missing, Democrats are set to hold onto Senate control, the UK economy contracted by 0.2% in Q3, Yellen says the US must raise its debt ceiling, LME will not ban trading of Russian metals, China is easing some of its Covid policies, the US is seeking 15 years and $800M in restitution payment for Elizabeth Holmes sentencing, and JPMorgan dodged a fat buyout-loan bullet by sitting out on Twitter and Citrix financings.

Today's edition is presented by EnergyFunders, the easiest way for ordinary investors to access private oil & gas deals. Check them out here. More info below.

Let's dive in.

Before The Bell

Market

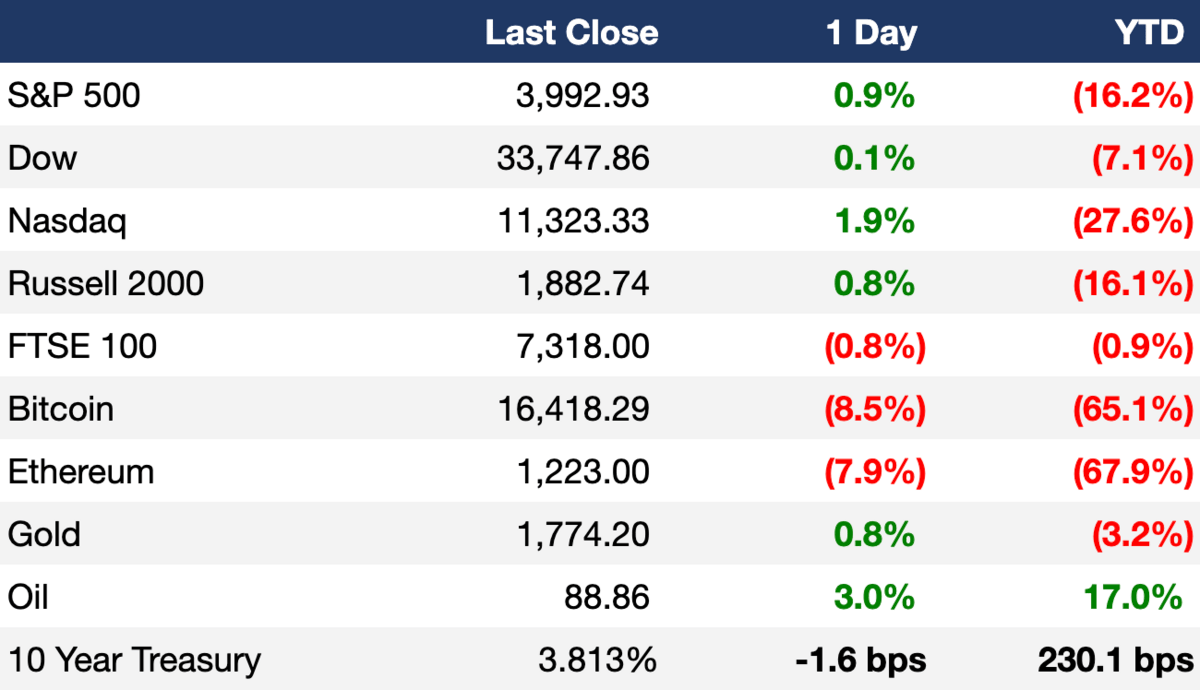

US stocks extended their gains on Friday as investors digested an optimistic CPI report

The S&P 500 and Nasdaq finished the week 5.9% and 8.1% higher, respectively

The dollar index slipped on Friday but remains up 10.8% YTD

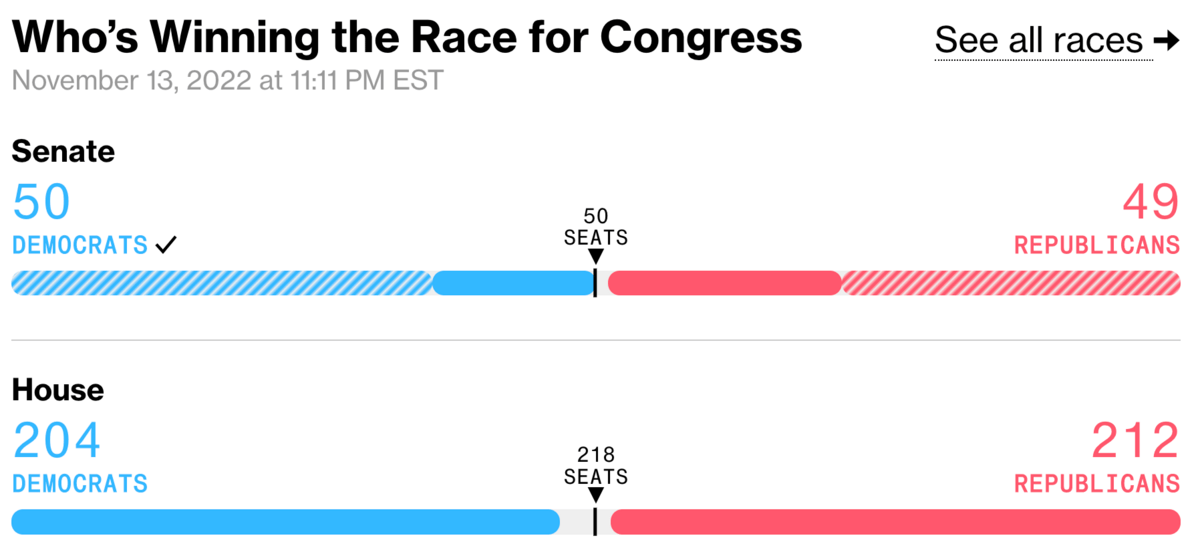

Investors digested news on the political front over the weekend, with Democrats set to keep control of the Senate in the 2022 midterm elections

On Tuesday, we'll receive October's PPI reading and on Wednesday, UK's CPI reading

Earnings

What we're watching this week:

Today: Nubank, Tyson Foods

Tuesday: Walmart, Home Depot

Wednesday: Tencent, Nvidia, Victoria's Secret

Thursday: Alibaba, Gap

Friday: JD.com

Full calendar here

Headline Roundup

US consumer sentiment fell 8.7% MoM in November (CNBC)

UK economy contracted 0.2% in Q3 (CNBC)

Janet Yellen warned that US must lift debt ceiling (RT)

Global sovereign debt levels rose sharply in 2021, with China accounting for 66% of lending by official bilateral creditors (RT)

London Metal Exchange will not ban trading of Russian metals (RT)

China eased some Covid curbs in adjustment to zero-Covid policy (AX)

US 'on track' to meet Paris Agreement: Biden (AX)

Ontario will extend its gas and fuel tax cut for a year (RT)

UK is considering a big increase in energy windfall tax (RT)

Chinese regulators urged more financing support for property firms (RT)

Democrats will keep Senate control by narrow margin (AX)

2022 US midterm elections drew ~30% less TV viewers than in 2018 (AX)

More voters prefer Ron DeSantis to Trump as 2024 GOP nominee: poll (AX)

BlackRock shelved plans for its China bond ETF (FT)

JPMorgan avoided steep losses by steering clear of major buyout debt deals unlike rival banks (WSJ)

Ad giant Omnicom recommended clients to pause Twitter ad spend (RT)

Musk is culling Twitter contractors after mass employee layoffs (AX)

DoE pulled student debt relief applications from its website (AX)

A heavy metal drummer's $56B lawsuit against Elon Musk will go to trial (RT)

US is seeking 15 years and $800M for Elizabeth Holmes over Theranos fraud (RT)

SpaceX bought a big ad campaign on Twitter for Starlink (CNBC)

A Message From EnergyFunders

Invest in Private Market Oil & Gas Deals

At a time when stocks, bonds, real estate, and alternative assets like gold have sustained losses, oil & gas investments have provided a rare opportunity for positive returns in 2022.

But energy stocks remain vulnerable to market volatility. Plus, after the recent outperformance, valuations for many public energy stocks have increased, creating risk for today’s investors.

EnergyFunders offers private market investment vehicles that bypass these risks. Get direct access to investments in oil and gas wells, managed by a team of veteran geologists and engineers. Take advantage of today’s unique economics for private market deals, which one Wall Street Journal article described as “almost too good to be true.”

In today’s market, large public energy companies are focusing capital budgets on share buybacks and dividends instead of drilling new wells. As Dan Pickering of Pickering Energy Partners explained earlier this year:

“The real winners right now are the private companies… Prices are high, and the little guys are quickly adding production to take advantage.”

That’s how EnergyFunders is finding opportunities like the Parker #10 - which repaid 100% of its principal investment within 90 days.

Eligible investors can earn deductions on their current year's tax bill by investing before December 31, 2022.

Learn how you can take advantage of this opportunity today by clicking here!

Deal Flow

M&A / Investments

Cosmetics company Estee Lauder is nearing a deal to buy US luxury fashion brand Tom Ford at a potential $2.8B valuation (BBG)

German military equipment manufacturer Rheinmetall agreed to buy Spanish explosives and ammunition maker Expal Systems for ~$1.2B (RT)

Italy’s billionaire Benetton family and Blackstone are set to move forward with their bid for infrastructure firm Atlantia, even after their takeover fell short of the required required 90% shareholder threshold (BBG)

KKR is in talks to invest $500M in clean battery maker Freyr Battery (BBG)

PE firm Aurelius is in talks to buy the remaining part of German airline Lufthansa’s catering arm (BBG)

Indian billionaire Mukesh Ambani has expressed interest in buying English football club Liverpool FC (BBG)

VC

IPO / Direct Listings / Issuances / Block Trades

Bankruptcy / Restructuring

Crypto exchange FTX filed for Chapter 11 bankruptcy protection; SBF stepped down as CEO (CNBC)

Crypto Corner

This is pretty much the FTX section for the next week lol

Investors have lost over $2T in crypto since its peak last November (CNBC)

SBF secretly moved $10B in FTX funds to trading firm Alameda, with up to $2B in customer funds now missing from FTX (RT)

Crypto transfers from FTX to Alameda Research were explicitly forbidden under firm's terms of service (AX)

Alameda and FTX executives knew FTX was using customer funds (RT)

FTX was hit by rogue transactions seeing an estimated ~$600M in outflows (RT)

Half of HF Galois' capital is stuck on FTX exchange (FT)

FTX users are cashing out of FTX accounts through a Bahamas loophole (CNBC)

Exec's Picks

Rally’s digital art project layers NFT minting, dead simple payment with credit cards, physical collectibles, and in-person experiences. Learn More and Get Early Access.

Equal Ventures' Rick Zullo wrote a great article on unaddressed opportunities for emerging managers in the VC space

Coinbase's Brian Armstrong penned on Op-ed on CNBC calling for stronger crypto regulation

The Hiring Block 💼

If you're looking to break into finance, lateral, or move out, check out our job board on Pallet, where we curate highly relevant roles for you. We aim to curate jobs across IB, S&T, VC, tech, private equity, DeFi, crypto, CorpDev and more. We'll sift through all the noise on LinkedIn, Indeed, Monster, etc. so you don't have to.

If you're a company looking to hire candidates and want to list a job opening on our board and feature on Exec Sum, click the button below:

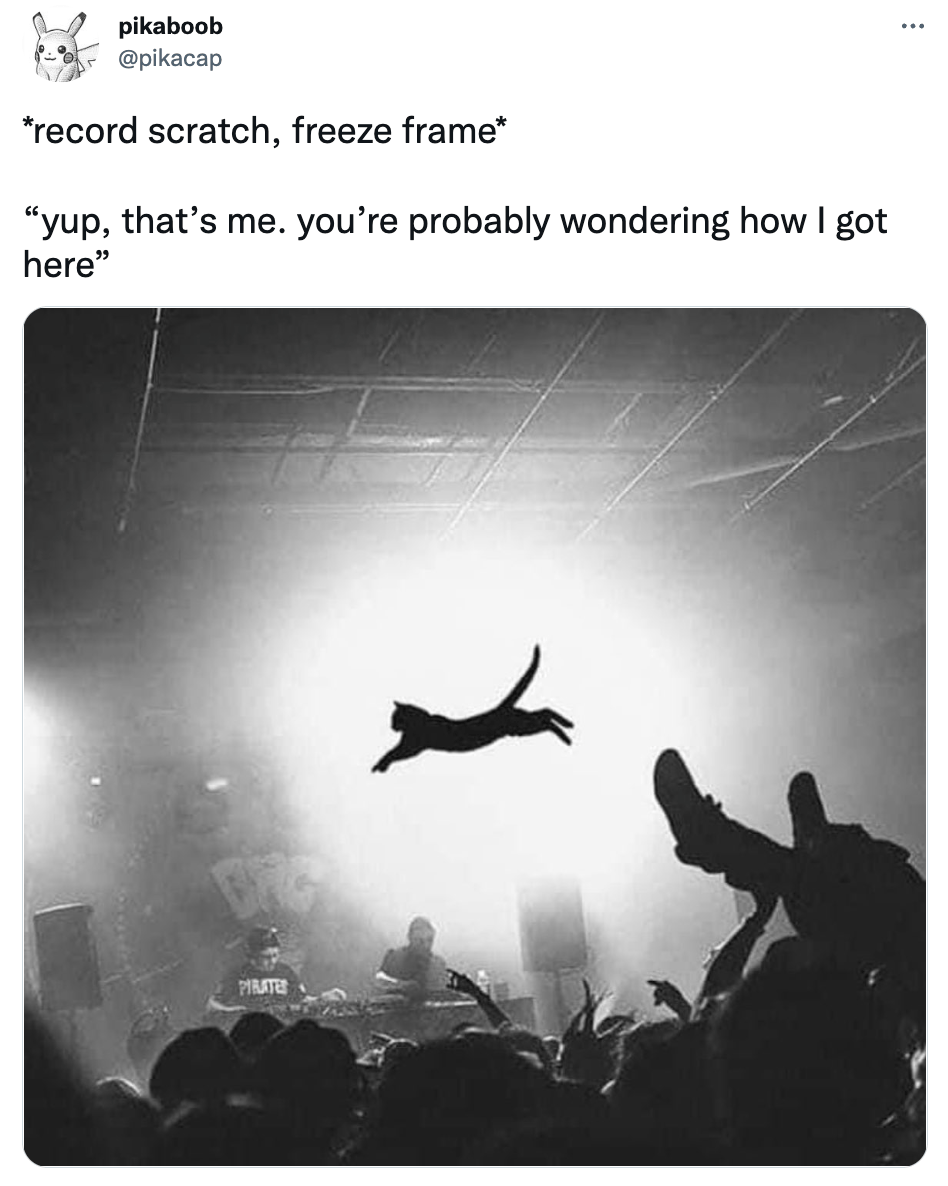

Meme Cleanser

Thinking of starting your own newsletter? Beehiiv is the best platform for creators, period. Click here to get started building your own audience.