Together with

Good Morning,

Oil prices are approaching $100/barrel, debris of the missing F-35 fighter jet may have been found in South Carolina, negotiation talks resumed in Detroit as UAW threatened to widen its strike, Morgan Stanley got sued by PE firms for $750M, and Salesforce is rehiring former execs.

You don’t have to sacrifice style to keep your crypto safe offline. If you want a cold wallet that matches your taste, check out today’s sponsor, Ledger.

Let’s dive in.

Before The Bell

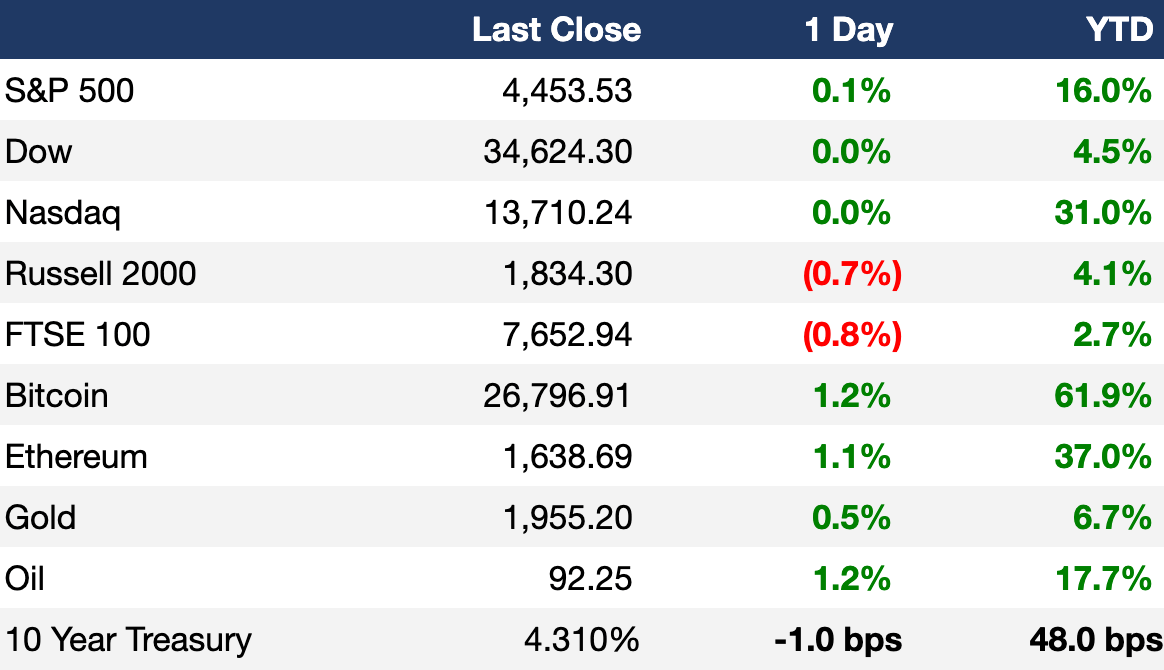

As of 9/18/2023 market close.

Markets

US stocks closed largely unchanged as investors await the Fed’s meeting this week

The S&P led indices with a 0.07% gain

WTI prices continued their climb upwards with a 1.63% gain to $92.25/barrel

European stocks fell ahead of a slew of central bank meetings, led by a 1.39% decline in France’s CAC, after Societe Generale’s strategic plan disappointed investors (RT)

Earnings

What we're watching this week:

Today: AutoZone

Wednesday: FedEx, General Mills

Thursday: Darden Restaurants

Full calendar here

Headline Roundup

Debris field that may be linked to missing F-35 fighter jet found in South Carolina (WSJ)

Talks resume in Detroit as UAW threatens to widen strike (WSJ)

Surging physical oil market brings $100 crude back in sight (BBG)

Tesla, Saudi Arabia in early talks for EV factory (WSJ)

Morgan Stanley sued for $750M by private equity firms claiming fraud (BBG)

BlackRock strategists downgrade China stocks on growth concerns (BBG)

The Fed isn’t getting the economy it expected (WSJ)

Elon Musk says Twitter, now X, is moving to small monthly subscription and has 550M monthly users (CNBC)

Arm Holdings shares slide as options draw robust trading volume (RT)

More SE Asia firms consider US IPOs, filling void left by China peers (RT)

Pot stock rally burns short sellers for $105M (BBG)

Striking unions impacting the economy at a level not seen in decades (CNBC)

Wall Street gearing up for Fed’s ‘hawkish pause’ (BBG)

Citi sees homebuilding investors tuning out through year-end (BBG)

Salesforce turns to ‘boomerangs,’ luring back former execs to help reignite growth (CNBC)

A Message From Ledger

Ledger Nanos, now in Ruby Red!

You red it right, Ledger's uncompromising security is now available in a brand new color. The Ledger Nano X and Ledger Nano S Plus are powered by the Secure Element Chip technology and keeps your private keys offline. Secure and manage thousands of coins like Bitcoin and Ethereum, plus tokens and NFTs with a Ledger Nano that matches your style and taste.

Don’t miss out on your next transaction. Visit the Ledger shop today.

Deal Flow

M&A / Investments

Global credit manager Marathon Asset Management will bid for Signature Bank’s $33B commercial real estate loan portfolio (BBG)

Gold miner Newmont received regulatory approval from Australia to proceed with its proposed $16.9B acquisition of Australia's Newcrest Mining (RT)

Oil industry data supplier TGS agreed to buy Norwegian rival PGS in an all-share deal to form a $2.6B data firm (BBG)

PE firms Hg and Permira are exploring strategic options, including a minority sale, for their stakes in German software firm Personal & Informatik; a deal could value the HR software provider at over $2.1B (RT)

Hitachi offered to sell French and German assets in a bid to address EU antitrust concerns about its $1.8B purchase of Thales' GTS railway signaling business (RT)

US PE firm Paine Schwartz Partners lowered offer price to buy Australian horticultural company Costa Group by $64M to a $958M valuation (RT)

British paper and packaging company Mondi agreed to sell its largest plant in Russia to to a unit of real estate developer Sezar Group for $826M cash (RT)

KKR agreed to pay $807M for a 20% stake in Singapore Telecommunications’ regional data center business (BBG)

Gulf Pharmaceutical Industries is exploring the sale of its Middle Eastern retail pharmacy network and is seeking ~$272M (BBG)

Knowles, a supplier of high-performance components and solutions, will acquire capacitor manufacturer Cornell Dubilier for up to $263M cash (BW)

Disney held preliminary talks with potential buyers, including billionaire Mukesh Ambani’s Reliance Industries, for its India streaming and television business (BBG)

CVC Capital Partners is exploring options for its Finnish healthcare company Mehilainen (BBG)

Canadian fund Ontario Teachers Pension Plan acquired stakes in Australian environmental markets platform GreenCollar from KKR and other shareholders (RT)

VC

Nephron Pharmaceuticals, a provider of inhalation solutions and suspension products, raised $350M in funding led by BlackRock, PNC, and National Association (FN)

Indigo Ag, a sustainable agriculture startup, raised $250M in funding led by Flagship Pioneering, State of Michigan Retirement System, and Lingotto Investment Management (FN)

Writer, a startup developing an ‘enterprise-focused generative AI platform’, raised a $100M Series B at a $500M valuation led by ICONIQ Growth (TC)

Dragos, a startup building software to secure manufacturing and industrial equipment control systems, raised a $74M Series D extension at a $1.7B valuation led by WestCap (TC)

Canton Biologics, a Guangzhou-based molecule biopharmaceutical CDMO, raised a ~$41.2M Series C led by SDIC Venture Capital (FN)

Enterprise-focused web3 orchestrator Bastion raised a $25M seed round led by a16zcrypto (FN)

Genomics company Broken String Biosciences raised a $15M Series A led by Illumina Ventures and Mérieux Equity Partners (BW)

Sports media and sports publisher The Sporting News raised $15M in funding led by Playtech (FN)

Mojave, a startup providing liquid desiccant systems, raised a $12.5M round led by At One Ventures and Fifth Wall (FN)

Boxbot, a startup helping last-mile carriers sort and store packages, raised a $12M Series A led by Playground Global (BW)

Series AI, a US-based game technology and content company, raised a $7.9M seed round from A16Z Games, Bitkraft, F4 Fund, and the Siqi Chen Access Fund (FN)

Hearth, a digital whiteboard startup for families, raised a $4.7M round from Ingeborg Investments, Stellation Capital, and more (FN)

Le Petit Lunetier, a Paris-based eyewear brand, raised a $4M round led by Neso Brands (FN)

Reskilling platform Catalyte raised a $1.5M round led by Green Street Impact Partners (FN)

Roam, a startup providing low-rate mortgages included in home purchases, raised a $1.25M seed round led by Founders Fund (FN)

IPO / Direct Listings / Issuances / Block Trades

Instacart is planning to sell shares in its IPO at $30 or more; the grocery delivery firm would have a $9.9B fully diluted equity valuation at $30/share (BBG)

Marketing automation company Klaviyo increased its proposed price range for its IPO and is targeting a fully diluted equity valuation of up to $9B; it is seeking to raise up to $557M (RT)

The medical vials division of Schott launched its IPO offering on Monday and is aiming to raise up to $1.1B at a valuation of up to $4.6B (RT)

Omani energy firm OQ is seeking to raise up to $771M in the IPO of its gas pipelines unit, giving the OQGN a $1.6B valuation (BBG)

Spanish travel technology firm Hotelbeds is interviewing banks for a $1.1B IPO next year (RT)

The IPO of Samhi Hotels, the operator of Marriott, Hyatt and IHG hotels in India, was oversubscribed by 5 times (RT)

Steel tycoon Sajjan Jindal’s ports unit JSW Infrastructure plans to raise up to $336M through what is set to be India’s second-biggest IPO this year (BBG)

Carrier Global is exploring a stock market listing of its commercial and residential fire unit (BBG)

Spanish airline Volotea hired Morgan Stanley and Barclays for a possible listing on the Madrid stock market (RT)

SPAC

Mobile game publishing company Gamehaus will merge with Golden Star Acquisition Corp. in a $500M deal (BZ)

Debt

Bankruptcy / Restructuring

Canada's Metroland Media Group will seek bankruptcy protection and will stop printing over 70 weekly community newspapers (RT)

Fundraising

Crypto VC Blockchain Capital closed its sixth early-stage fund and its first opportunities fund at $580M (TC)

Lowercarbon Capital raised over $550M for two new venture funds- one for pre-seed and seed-stage startups, and a second to double down on portfolio companies (AX)

Italy’s FIEE Sgr raised ~$100M for SpesX Energy Transition, a new long-short fund that will bet on the debt and equity of companies involved in the carbon transition (BBG)

Crypto Corner

Exec’s Picks

Alex Sherman explained what Disney selling its legacy media assets might mean for the company moving forward.

This Wall Street Journal piece explains how music streaming has changed song and album structure.

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter