Together with

Good Morning,

The Fed thinks higher rates are needed to reach inflation goals, Threads hit 100M users, Uber’s CFO stepped down, Flexport founder Ryan Petersen joined Founders Fund, Turkey approved Sweden’s NATO bid, the EU is investigating Ozempic after suicidal thoughts were reported, and The New York Times is dismantling its sports desk.

Need to rehydrate after a big weekend in the Hamptons? Check out today’s sponsor, LMNT, for the hottest zero-sugar hydration supplement on the market.

Let’s dive in.

Before The Bell

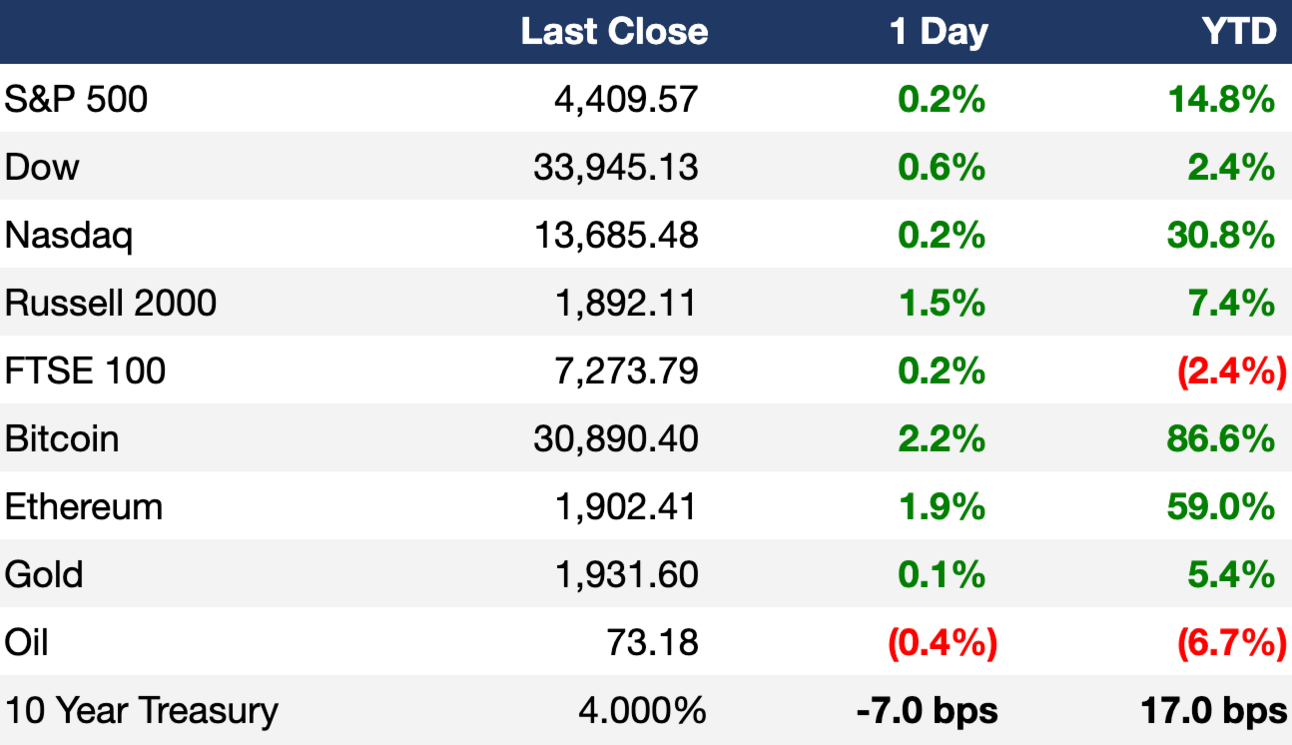

As of 7/10/2023 market close.

Markets

US stocks rose slightly yesterday as investors brace for inflation data and a slate of earnings

The pan-European Stoxx 600 gained 0.2% after continuing to decline past three-month lows it hit last week

Yield on 10Y TIPS rose to 1.82% to the highest level since 2009

Dollar index sank to a three-week low

Earnings

What we're watching this week:

Thursday: PepsiCo, Delta

Friday: JPMorgan, Wells Fargo, Citigroup, BlackRock, State Street, UnitedHealth

Full calendar here

Headline Roundup

Fed officials say higher rates needed to reach 2% inflation goal (BBG)

Threads reached 100M users faster than ChatGPT (RT)

Rise of Threads is causing Twitter traffic to drop (WSJ)

Fed’s regulatory chief proposed boosting banks' capital requirements (WSJ)

Global hedge funds are up 3.4% YTD on AI gain (RT)

Hedge funds slashed bets on US stocks to lowest level in over a decade and pivoted to Europe (FT)

Goldman predicts Indian economy to overtake US by 2075 (CNBC)

Uber CFO to step down in most senior executive exit since IPO (BBG)

US senators to get classified White House AI briefing on Tuesday (RT)

Amazon’s Prime Day to test consumer demand (WSJ)

Turkey approved Sweden’s bid to join NATO (WSJ)

Meta singled out by UK financial lobby group over digital scams (FT)

Deutsche Bank's DWS face allegations of 'greenwashing' (RT)

EU investigates Ozempic, weight-loss drug Saxenda after suicidal thoughts reported (RT)

Morgan Stanley hired JPMorgan's North America M&A head as vice-chairman of M&A (RT)

New York Times to dismantle sports desk, rely on The Athletic for coverage (RT)

UK health regulator approves GSK's vaccine for common respiratory virus RSV (RT)

A Message From LMNT

Zero Sugar Hydration for Summer 2023

It is officially summertime, which means you’re celebrating by spending your weekends 20-deep in a Hamptons sharehouse. There’s just one problem: a big weekend with friends always leads to a rough Monday in the office, and some hangovers require more than coffee and water.

LMNT is an electrolyte drink mix, but not like any electrolytes you’ve had before. It contains 1,000mg of sodium, 200mg of potassium, and 60mg of magnesium. But most importantly, 0mg of sugar, 0mg of coloring, and no artificial ingredients or gluten. Basically, it’s the perfect recipe to rehydrate and help prevent headaches and cramps.

Yeah, you can use LMNT after workouts. But it’s also the secret sauce for recovering from a big day of drinking. If you’re the work hard, play hard type, try LMNT here, and get a free sample pack with any order.

Deal Flow

M&A / Investments

A unit of China’s state-owned conglomerate China Merchants Group made a $3.4B offer to acquire Asian data center designer and operator Chindata Group (RT)

A unit of Warren Buffett's Berkshire Hathaway will buy a 50% stake in the Cove Point liquefied natural gas facility from Dominion Energy for $3.3B cash (RT)

German industrial conglomerate Siemens is gauging interest from potential buyers for its Innomotics unit, which could be valued at $3.3B (BBG)

The DoJ is nearing a decision on whether to challenge Thoma Bravo’s $2.3B buyout of ForgeRock (RT)

UK PE firm Inflexion is in talks to acquire British law firm DWF Group for $438M (BBG)

Bain Capital is in talks to buy Indian ice cream maker Vadilal, which it valued at $363M, and is also interested in taking control of Vadilal Industries and Vadilal Enterprises, the entities responsible for making and marketing Vadilals’ ice cream (RT)

Nestlé is weighing a potential sale of its peanut allergy medicine Palforzia to Swiss health-care group Stallergenes Greer (BBG)

MediaNews Group, a local newspaper company owned by HF Alden Global Capital, acquired San Diego Union-Tribune from billionaire biotech exec Patrick Soon-Shiong for an undisclosed sum (AX)

Postmedia Network Canada ended discussions with Nordstar Capital over a possible merger of some operational assets from Toronto Star and the Metroland newspapers (RT)

VC

Ophthalmic therapeutics startup SpyGlass Pharma raised a $90M Series C led by RA Capital Management (FN)

Healthcare credentialing software Verifiable raised a $27M Series B led by Craft Ventures (TC)

Arrcus, a hyperscale networking software company, raised a $24M Series D extension led by Hitachi Ventures (BW)

Wildfire detection startup Pano AI raised a $17M Series A extension led by Valor Equity Partners (TC)

The Solubility Company, a startup providing solubility measurement software, raised $10M in funding led by Microsize (BW)

Spreadsheet replacement startup Sourcetable raised a $3M seed round led by Bee Partners (TC)

B2B technologies, a startup creating ways of doing business using the internet, raised an undisclosed amount in funding led by BluAlly Technology Solutions (FN)

Dublin-based EV charging startup Go Eve raised $3M in first funding from Carter Gem, Automotive Ventures Inc., Kero Development Partners, and more (FN)

IPO / Direct Listings / Issuances / Block Trades

China-owned agriculture giant Syngenta hired banks including Citigroup, HSBC, JPMorgan and UBS to court sovereign funds for its potential $9B IPO (BBG)

Israel’s Oddity Tech, a beauty and wellness company, will seek a valuation of up to $1.7B in its US IPO (RT)

Medical firm Genesis MedTech is weighing an up to $500M Hong Kong IPO (BBG)

Debt

Bankruptcy / Restructuring

South Korea’s financial service regulator asked major banks to prepare ~$4B in financing to support MG Community Credit Cooperatives, which was hit by customer withdrawals after a report about a rise in non-performing real estate loans (RT)

Distressed UK water services company Thames Water, which is struggling with $18B in debt, has secured $960M from investors and staved off the threat of nationalization (RT)

The insolvency administrator of Go Airlines India is seeking initial bids from prospective investors (BBG)

Chinese property developer Kaisa Group is facing a winding-up petition in Hong Kong in relation to $24M non-payments on onshore bonds (RT)

The owner of Margaritaville Resort Times Square Hotel filed for Chapter 11 bankruptcy protection after disappointing results since its 2021 opening (BBG)

Fundraising

Crypto Corner

Exec’s Picks

Thanks to hidden pay for order flow, free stock trading isn’t really free. We The Investors gives a unified voice to a community of investors that has for too long been divided and conquered. Join the movement of more than 100,000 strong by clicking here.

Kyla Scanlon wrote an excellent piece on how Gen-Z looks at job satisfaction.

Byrne Hobart discussed whether or not it was worth it for Facebook to become “Meta.”

Litney Partners - Financial Recruiting 💼💼

If you're currently a junior investment banker looking to break into the buy side, considering lateraling to another investment bank, or have recently been impacted by widespread layoffs, it's time you check out Litney Partners, a partnership between Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates at leading private equity, hedge fund, venture capital, growth equity, and credit funds, as well as investment banks.

To get started, simply head over to the Litney website and create your profile by dropping your resume / filling out the form:

Meme Cleanser

Advertise with us // Visit our merch store // Invest alongside Lit Ventures // Book a call with Lit // Launch your own newsletter