Together with

Good Morning,

Quant funds disappointed in 2024, US revealed a privatization path for Fannie Mae and Freddie Mac, US Steel's CEO tore Biden a new one, Centerview Partners is weighing an IPO after posting a record year, and 0DTE options became the most popular option contract on the S&P 500.

Whether you work with early-stage startups or growing enterprises, Brex offers the complete financial stack for your firm. Optimize all your PortCos' banking needs with Brex, startup banking that takes every dollar further.

Let's dive in.

Before The Bell

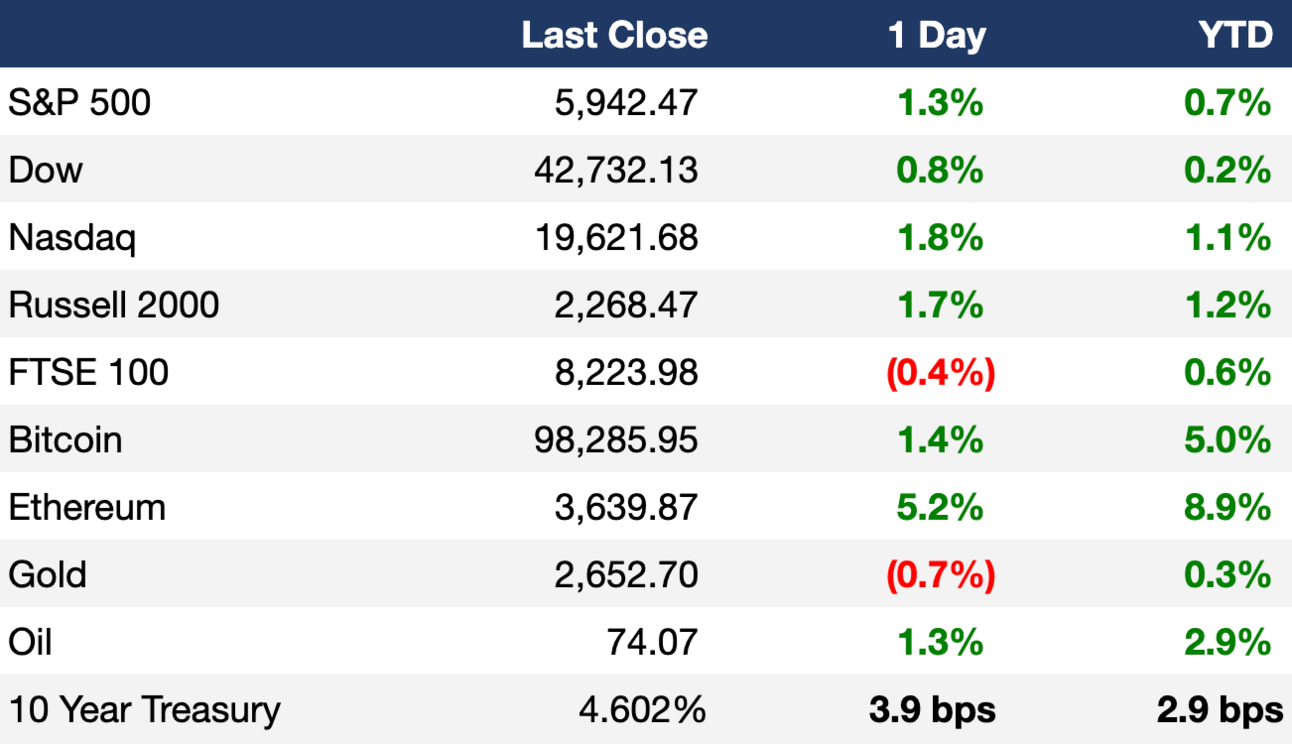

As of 1/3/2025 market close.

Markets

US stocks rebounded on Friday to cut losses from a shaky start to the new year

S&P and Nasdaq snapped a five-day losing streak

China 2Y yield dropped to 1% for the first time ever

Gold-EM currencies correlation turned the most negative in three years

Aussie dollar had its worst year since 2018

US natural gas prices are up 14% MoM amid imminent polar vortex

Earnings

What we're watching this week:

Wednesday: Jefferies, Albertsons

Friday: Delta, Walgreens, Constellation Brands

Full calendar here

Prediction Markets

Justin Trudeau is expected to resign. See how markets are betting on Canada's PM succession.

Headline Roundup

Quants funds saw big year go bust in cross-asset spiral (BBG)

Stock picking hedge funds posted the best returns since Covid (RT)

US is set for an IPO comeback as PE firms seek to exit (FT)

Trading disruptors mimicking banks are expected to beat them (RT)

Spike in failed trades shows persistent 20Y US bond shortage (BBG)

0DTE options are the most popular options on S&P 500 (BBG)

Accounting firms want to block new US disclosure rules about auditors (FT)

Trader who made billions in 2008 returns to bet on market swings (BBG)

Trump haunts central banks primed for wary rate cuts in 2025 (BBG)

Trump, Fed seen risking $127B bond spree in Latin America (BBG)

China will sharply increase ultra-long treasury bond funding in 2025 (RT)

Korean markets ride out crisis as global debt funds keep buying (BBG)

Trump named Kalshi exec Samantha Schwab to Treasury (X)

US revealed a privatization path for Fannie Mae and Freddie Mac (RT)

Nazi ties to Credit Suisse ran deeper than previously known (WSJ)

AQR multi-strategy returned 15% YoY on equity and macro gains (BBG)

CrowdStrike shares recovered all losses since global IT outage (FT)

Japanese firms are pulling out all the stops to recruit young workers (BBG)

Goldman Sachs named Alex Golten as its new chief risk officer (RT)

An Asian VC sued PayPal for racism in investment program (WSJ)

US Steel CEO ripped Biden for blocking merger (US)

Hybrids help boost US new car sales to five-year high (RT)

Canada aims to become world's biggest uranium producer (FT)

Generation Beta has arrived (AX)

Corporate execs are being hit by AI-generated phishing scams (FT)

US Surgeon General linked alcohol to cancer (NYT)

NYC debuted congestion pricing (BBG)

A Message from Brex

Startup Banking That Takes Every Dollar Further

Brex knows runway is everything for venture-backed startups, so they built a banking solution that helps them take every dollar further.

Unlike traditional banking solutions, Brex has no minimums and gives startups access to 20x the standard FDIC protection via program banks.

Plus, startups can earn industry-leading yield from their first dollar — while being able to access their funds anytime.

If you want to make sure your portfolio companies have a place to save, spend, and grow their capital, check out Brex.

Deal Flow

M&A / Investments

US blocked Japanese steelmaker Nippon Steel's $14.1B acquisition of US Steel on national security concerns

$50B-listed payroll processor Paychex is in advanced talks to acquire $3.3B-listed peer Paycor

$980M-listed Getty Images is exploring a merger with $1.1B rival Shutterstock

CC Capital Partners offered to acquire Australian wealth manager Insignia Financial for $1.8B, beating a $1.66B offer from Bain Capital

PE firm Canyon Bridge Capital Partners is seeking to sell chip designer Imagination Technologies for over $680M

Digital-asset prime brokerage firm FalconX acquired crypto derivatives startup Arbelos Markets

Centerview Partners is open to a stake sale or IPO after receiving interest from big investors

Disgraced hedge fund founder Simon Sadler is seeking to sell UK football club Blackpool FC

VC

KoBold Metals, a startup using AI to find copper, raised a $537M Series C led by Durable Capital Partners and T Rowe Price

Electra, a startup using electricity to purify iron, raised $180M in funding from a variety of undisclosed investors

Cimulate, a startup helping brands meet consumer demands, raised a $28M Series A led by Spark Capital

Belgian holographic display startup Swave Photonics raised a $29.5M Series A led by imec.xpand and SFPIM Relaunch

Jentic, an Irish startup building an integration layer for AI, raised a $4.3M pre-seed round led by Elkstone

Construction tech startup StruxHub raised a $4M seed round led by Brick and Mortar Ventures

IPO / Direct Listings / Issuances / Block Trades

MicroStrategy is seeking to raise $2B more in preferred stock to buy more Bitcoin

BC Partners and Pollen Street Capital are planning to IPO UK lender Shawbrook at an over $2.5B valuation

SPAC

Online firearms retailer GrabAGun agreed to merge with Colombier Acquisition Corp. II in a $150M deal

Fundraising

Peter Thiel-backed venture debt firm Tacora Capital raised $269M for its second fund

Crypto Sum Snapshot

BlackRock's Bitcoin ETF recorded its largest ever daily outflow (BBG)

FDIC warned banks on crypto but did not order halt to business (RT)

Check out Crypto Sum for the full stories on everything crypto!

Exec’s Picks

⏳ Time is Running Out: Enroll by January 13th! Make 2025 the year you take your career to new heights with the Private Equity Certificate Program from Wharton Online and Wall Street Prep. This 8-week online course is perfect for professionals aiming to upskill in PE or break into the industry. Gain insights from industry leaders, master technical skills, and earn a digital certificate from Wharton Online. Enroll by January 13th and use code LITQUIDITY to save $500—secure your spot now!

Novel Investor published the annual performance of S&P 500 sectors, going back to 2010.

With markets ending 2024 on a high, Ben Carlson shared some insights reminding us that good years in the stock market tend to cluster.

Financial Services Recruiting 💼

If you're a junior banker looking for your next career move, check out Litney Partners, a recruiting firm established by Litquidity and Whitney Partners (the oldest purely financial services executive search and consulting firm).

We aim to place strong candidates across private equity, hedge funds, venture capital, growth equity, credit, and investment banking.

We're currently seeking talent for some incredible roles. Head over to Litney Partners to drop your resume / create your profile and we'd love to get in touch!

Meme Cleanser

🛒 Merch Store: Visit our merch store to shop our latest apparel, shoes, bags, accessories and more.

💵 Litquidity Ventures: Accredited investors & qualified purchasers within the Litquidity community can gain access to alternative investments such as venture, late-stage growth, and private equity through Litquidity Ventures. Interested? Fill out this form.

☎️ Book a call with Lit: Want to pick Litquidity's brain on business advice, insights, or just chat to say what's up? Buy his time here.

📧 Launch your own newsletter: Have great content ideas and looking to launch your own publication? We highly recommend Beehiiv to get started.